DEF 14A: Definitive proxy statements

Published on April 24, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

|

No fee required. |

☐ |

|

Fee paid previously with preliminary materials. |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

AerSale Corporation

NOTICE & PROXY STATEMENT

Annual Meeting of Stockholders

June 5, 2025

10:30 a.m. (Eastern time)

AERSALE CORPORATION

9850 NW 41st St., Suite 400

Doral, Florida 33178

April 24, 2025

To Our Stockholders:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of AerSale Corporation. at 10:30 a.m. Eastern time, on Thursday, June 5, 2025. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

The accompanying Notice of Annual Meeting and Proxy Statement describe the matters to be presented at the Annual Meeting. Please see the section called “Who can attend the Annual Meeting?” on page 4 of the Proxy Statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting online, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote online, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

/s/ Nicolas Finazzo

Nicolas Finazzo

Chairman and Chief Executive Officer

TABLE OF CONTENTS

AERSALE CORPORATION

9850 NW 41st St., Suite 400

Doral, Florida 33178

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD THURSDAY, JUNE 5, 2025

The Annual Meeting of Stockholders (the “Annual Meeting”) of AerSale Corporation, a Delaware corporation (the “Company”), will be held at 10:30 a.m. Eastern time on Thursday, June 5, 2025. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting. In order to attend the virtual meeting you will need to register for the meeting at www.proxydocs.com/ASLE using your 12-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied your proxy materials. Once you have registered, you will be given a unique link to our meeting portal where you can access the Annual Meeting on the meeting day and vote during the meeting.

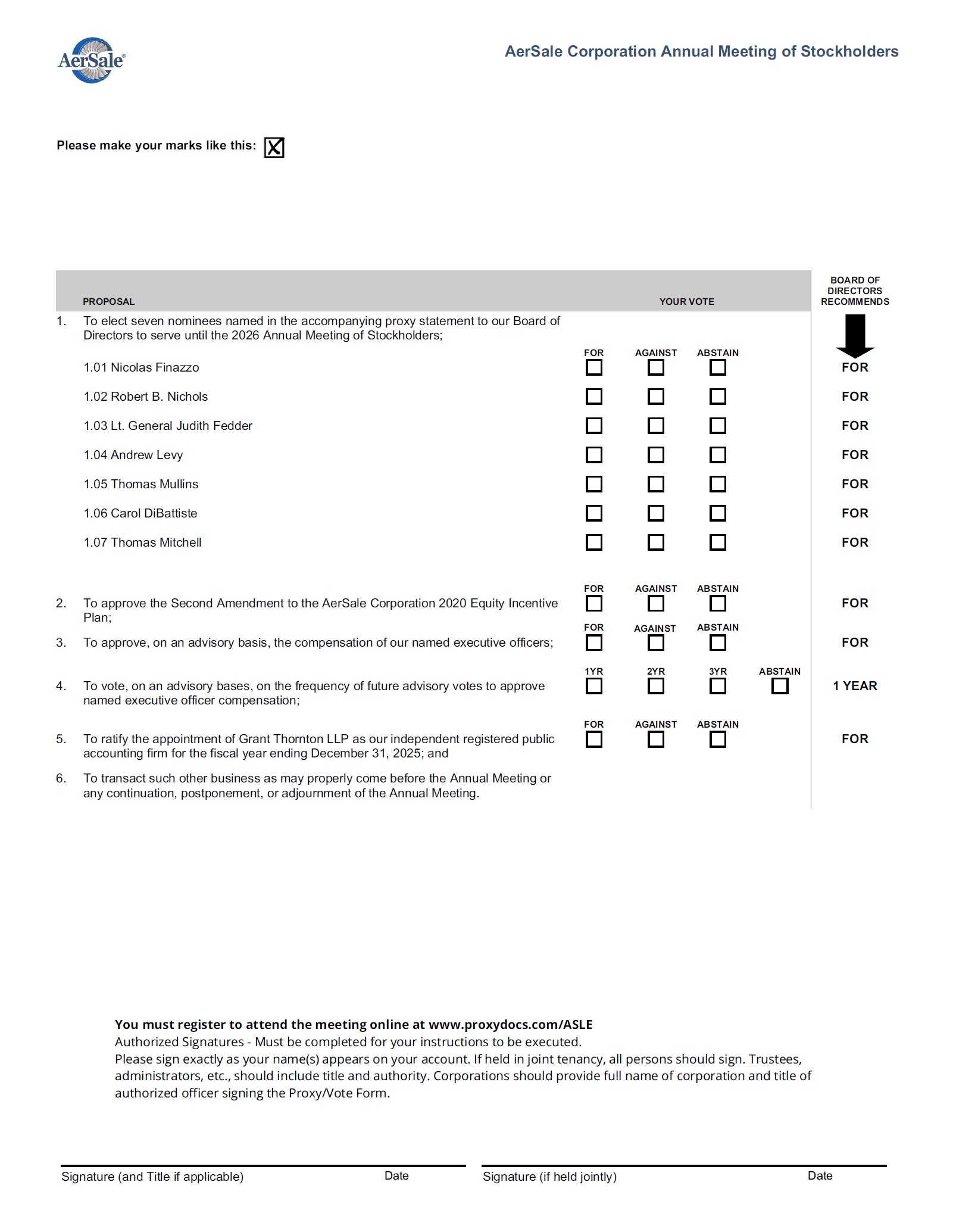

The Annual Meeting will be held for the following purposes:

|

Proposal 1:

|

|

To elect each of the seven nominees named in the accompanying proxy statement to our Board of Directors to serve until the 2026 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; |

Proposal 2: |

|

To approve the Second Amendment to the AerSale Corporation 2020 Equity Incentive Plan |

Proposal 3: |

|

To approve, on an advisory basis, compensation of our named executive officers; |

Proposal 4: |

|

To vote, on an advisory basis, on the frequency of future advisory votes to approve named executive officer compensation; and |

Proposal 5: |

|

To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. |

Holders of record of our common stock as of the close of business on April 9, 2025 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement, or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder at our principal executive offices at 9850 NW 41st St., Suite 400, Doral, Florida 33178 for a period of ten days prior to the Annual Meeting. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the 12-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the accompanying materials. If you received a copy of the proxy card by mail, you may sign, date, and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

AerSale, Inc. | i

By Order of the Board of Directors

/s/ Martin Garmendia

Martin Garmendia

Chief Financial Officer, Treasurer and Secretary

Doral, Florida

April 24, 2025

AerSale, Inc. | ii

Note Regarding Corporate History and Background

In this proxy statement, “AerSale”, the “Company”, “we”, “us”, and “our” refer to AerSale Corporation (f/k/a Monocle Holdings Inc.) and its consolidated subsidiaries. On December 22, 2020, Monocle Acquisition Corporation (“Monocle”) consummated the previously announced business combination pursuant to that certain Amended and Restated Agreement and Plan of Merger, dated September 8, 2020 (the “Merger Agreement”), by and among Monocle, the Company, AerSale Aviation, Inc. (f/k/a AerSale Corp.), a Delaware corporation (“AerSale Aviation”), Monocle Merger Sub 1 Inc., a Delaware corporation (“Merger Sub 1”), Monocle Merger Sub 2 LLC, a Delaware limited liability company (“Merger Sub 2”), and Leonard Green & Partners, L.P. (“Leonard Green”), a Delaware limited partnership, solely in its capacity as the initial Holder Representative (as defined in the Merger Agreement).

The transactions contemplated by the Merger Agreement are referred to herein as the “Merger” or the “Business Combination” and in connection therewith, Monocle merged with and into us, whereby we survived the Merger and became the successor issuer to Monocle by operation of Rule 12g-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Upon the consummation of the Merger: (a) Merger Sub 1 was merged with and into Monocle, with Monocle surviving the merger as a wholly-owned direct subsidiary of the Company (the “First Merger”), and (b) Merger Sub 2 was merged with and into AerSale Aviation, with AerSale Aviation surviving the merger as a wholly-owned indirect subsidiary of the Company (the “Second Merger”).

In connection with the closing of the Business Combination, AerSale Aviation changed its name from “AerSale Corp.” to “AerSale Aviation, Inc.” and the Company changed its name from “Monocle Holdings Inc.” to “AerSale Corporation.” Immediately following the Merger, the Company contributed all its ownership in Monocle to AerSale Aviation which will continue as a wholly owned subsidiary of the Company.

Forward-looking Statements

This proxy statement contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in this proxy statement, including statements regarding our environmental and sustainability plans and goals and the ability to launch new services and products or to profitably expand into new markets, may constitute forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this proxy statement reflect management’s current expectations and are inherently uncertain. These forward-looking statements speak only as of the date of this proxy statement and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described in our Annual Report on Form 10-K for the year ended December 31, 2024 and in any of our subsequent filings with the Securities and Exchange Commission (the “SEC”).

AerSale, Inc. | iii

PROXY STATEMENT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER

MEETING TO BE HELD ON THURSDAY, JUNE 5, 2025

This Proxy Statement and the 2024 Annual Report are available at www.proxydocs.com/ASLE

AERSALE CORPORATION

9850 NW 41st St., Suite 400

Doral, Florida 33178

This proxy statement is furnished in connection with the solicitation by the Board of Directors of the Company (the “Board” or the “Board of Directors”) of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, June 5, 2025 (the “Annual Meeting”), at 10:30 a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting. In order to attend the virtual meeting, you will need to register for the meeting at www.proxydocs.com/ASLE using your 12-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied your proxy materials. Once you have registered, you will be given a unique link to our meeting portal where you can access the Annual Meeting on the meeting day, and vote during the meeting

Holders of record of shares of our common stock as of the close of business on April 9, 2025 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 46,860,066 shares of common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2024 (the “2024 Annual Report”) will be released on or about April 24, 2025, to our stockholders on the Record Date.

AerSale, Inc. | 1

PROXY STATEMENT

Proposals

At the Annual Meeting, our stockholders will be asked:

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board

The Board of Directors recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by proxies will be voted, and the Board of Directors recommends that you vote:

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because AerSale’s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide you under the rules of the SEC and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, AerSale is making this proxy statement and its 2024 Annual Report available to its stockholders electronically via the Internet. On or about April 24, 2025, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 2024 Annual Report and vote online. If you received an

AerSale, Inc. | 2

PROXY STATEMENT

Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2024 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, you can visit www.proxydocs.com/ASLE to request materials.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please visit www.proxydocs.com/ASLE to request materials.

AerSale, Inc. | 3

QUESTIONS AND ANSWERS ABOUT THE ANNUAL

MEETING OF STOCKHOLDERS

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 9, 2025. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of common stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 46,860,066 shares of common stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are not registered in your own name and you would like to vote your shares at the Annual Meeting, you should contact your broker or other nominee to obtain your 12-digit control number or otherwise vote through the broker or nominee.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person virtually online or by proxy, of the holders of a majority of the issued and outstanding shares of common stock entitled to vote on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

AerSale is holding the Annual Meeting entirely online this year. You may attend and participate in the Annual Meeting by visiting the following website www.proxydocs.com/ASLE.

To attend and participate in the Annual Meeting, you will need the 12-digit control number included in your Internet Notice, on your proxy card, or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker. If you lose your 12-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions, or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 10:30 a.m. Eastern time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:15 a.m., Eastern time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting is authorized by our Amended and Restated Bylaws, as amended, to adjourn the meeting.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating, and returning the enclosed proxy card in the enclosed envelope.

AerSale, Inc. | 4

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern time, on June 4, 2025. To participate in the Annual Meeting, including voting via the Internet or telephone, you will need the 12-digit control number included on your Internet Notice, on your proxy card, or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote on your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote on your shares electronically.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted on. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote on your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker. If you lose your 12-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Annual Meeting using your 12-digit control number or otherwise vote through your bank or broker.

Who will count the votes?

A representative of Mediant a Business of BetaNXT, our inspector of election, will tabulate and certify the votes.

AerSale, Inc. | 5

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

A virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to attend the Annual Meeting online and submit your questions by visiting www.proxydocs.com/ASLE. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website, and the information for assistance will be located on www.proxydocs.com/ASLE .

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted by stockholders during the meeting that are pertinent to the Company and the meeting matters.

The Company will endeavor to answer as many questions submitted by stockholders as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above under “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders who have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?”.

AerSale, Inc. | 6

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

Proposal |

Votes required |

Effect of Abstentions and Broker Non-Votes |

Proposal 1: Election of Directors |

The majority of the votes cast. This means that the number of votes cast “FOR” a director’s election must exceed the number of votes cast “AGAINST” that director’s election. |

Abstentions and broker non-votes will have no effect on this proposal. |

Proposal 2: Approval of Second Amendment to the AerSale Corporation 2020 Equity Incentive Plan |

The affirmative vote of a majority of the outstanding shares present in person or by proxy at the Annual Meeting and entitled to vote. |

Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on this proposal. |

Proposal 3: Approval, on an advisory basis, of our named executive officer compensation (“say-on-pay”) |

The affirmative vote of a majority of the outstanding shares present in person or by proxy at the Annual Meeting and entitled to vote. |

Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on this proposal. |

Proposal 4: Advisory vote on the frequency of future advisory votes to approve named executive officer compensation (“say-on-frequency”) |

The option (i.e., every one year, two years, or three years) that receives the most votes will be considered the preferred option. |

Abstentions and broker non-votes will have no effect on this proposal. |

Proposal 5: Ratification of Appointment of Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2025 |

The affirmative vote of a majority of the outstanding shares present in person or by proxy at the Annual Meeting and entitled to vote. |

Abstentions will have the same effect as a vote against the proposal. We do not expect any broker non-votes on this proposal. |

|

|

|

What is an “abstention” and how will abstentions be treated?

An “abstention” represents a stockholder’s affirmative choice to decline to vote on a proposal. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Abstentions have no effect on the proposals relating to the election of directors, the Second Amendment to the AerSale Corporation 2020 Equity Incentive Plan, say-on-pay or say-on-frequency. Abstentions will have the same effect as a vote against the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors of AerSale, the approval of the Second Amendment to the AerSale Corporation 2020 Equity Incentive Plan, say-on-pay and say-on-frequency. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC within four business days of the Annual Meeting.

AerSale, Inc. | 7

PROPOSALS TO BE VOTED ON

PROPOSAL 1: ELECTION OF DIRECTORS

Upon the recommendation of the Nominating and Corporate Governance Committee of the Board, the Board has nominated, Nicolas Finazzo, Robert B. Nichols, Lt. General Judith Fedder, Andrew Levy, Thomas Mullins, Carol DiBattiste, and Thomas Mitchell to serve as directors until the 2026 Annual Meeting and until each such director’s respective successor is elected and qualified.

In accordance with our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws, each as amended, the Board of Directors will stand for election for one-year terms that expire at the following year’s annual meeting and until his or her successor has been elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, disqualification, or removal. Pursuant to our Amended and Restated Certificate of Incorporation, as amended, the total number of directors shall be fixed exclusively by resolutions adopted from time to time by the Board, which number is currently nine. Each of Peter Nolan and General C. Robert Kehler notified the Company of his intent not to stand for re-election to the Board at the Annual Meeting upon the expiration of his term. Their respective decisions were not due to any disagreements with the Company on any matter relating to the Company’s operations, policies or practices. The Board has set the size of the Board at seven, effective as of the date of the Meeting.

Proxies cannot be voted for a greater number of persons than the number of nominees named. Newly created directorships resulting from an increase in the number of directors and any vacancies on the Board resulting from death, resignation, retirement, disqualification, removal, or other cause may be filled solely and exclusively by a majority vote of the remaining directors then in office, even if less than a quorum, or by a sole remaining director (and not by stockholders).

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented thereby for the election as a director of the person whose name and biography appears below. In the event that any of Mr. Finazzo, Mr. Nichols, Lt. General Fedder, Mr. Levy, Mr. Mullins, Ms. DiBattiste or Mr. Mitchell should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board may elect to reduce its size. The Board of Directors has no reason to believe that any of the director nominees will be unable to serve if elected. Each of the director nominees has consented to being named in this proxy statement and to serve if elected.

Vote Required

The proposal regarding the election of directors requires the approval of a majority of the votes cast. This means that the number of votes cast “FOR” a director’s election must exceed the number of votes cast “AGAINST” that director’s election.

Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

|

Recommendation of the Board of Directors The Board of Directors unanimously recommends a vote FOR the election of each of the below director nominees. |

AerSale, Inc. | 8

PROPOSALS TO BE VOTED ON

The current members of the Board of Directors who are also nominees for election to the Board of Directors are as follows:

Name |

Age |

Position with AerSale |

Nicolas Finazzo |

68 |

Chairman, Chief Executive Officer, |

Robert B. Nichols |

68 |

Director |

Lt. General Judith Fedder |

67 |

Director |

Andrew Levy |

55 |

Director |

Thomas Mullins |

60 |

Director |

Carol DiBattiste |

73 |

Director |

Thomas Mitchell |

54 |

Director |

The following information with respect to the seven nominees is based on information furnished to the Company by each nominee and highlights the specific experience, qualifications, attributes, and skills of the individual nominees that have led the Board to conclude that each should continue to serve on the Board:

AerSale, Inc. | 9

PROPOSALS TO BE VOTED ON

Nicolas Finazzo |

||

|

Age: 68 Position: Chairman, Chief Executive Officer, and Director |

|

Nicolas Finazzo has served on our Board since December 2020. Mr. Finazzo co-founded AerSale Corp. in 2008 with Mr. Nichols and has served as Chairman and Chief Executive Officer from inception until January 2019, and again since December 2019. He has also served as Division President, TechOps since December 2019. From January 2019 to December 2019, Mr. Finazzo was Executive Chairman of AerSale Corp. From 1997 to 2008, Mr. Finazzo was Co-Founder and Chief Executive Officer of AeroTurbine, Inc., a supplier of aircraft and engine products and maintenance, repair and overall ("MRO") service provider. In 1997, Mr. Finazzo was Vice President and General Counsel of AeroThrust, Inc., a parts supplier, MRO service provider and aircraft engine leasing company. From 1991 to 1997, Mr. Finazzo was Vice President and General Counsel of International Air Leases, Inc., a used aircraft leasing company. From 1987 to 1991, Mr. Finazzo was Vice President of Contracts for Greenwich Air Services, a jet engine MRO service provider. From 1981 to 1987, Mr. Finazzo was President of Southern Express Airways, Inc., a commuter airline operating in the United States. Mr. Finazzo graduated from the University of Michigan with a Bachelor of Science degree in Political Science and earned a Juris Doctorate degree from the University of Miami School of Law. Mr. Finazzo is licensed to practice law in Florida and also holds a Federal Aviation Administration Airframe and Powerplant Mechanic license. As one of our founders, Chairman and Chief Executive Officer, Mr. Finazzo brings to the Board significant senior leadership and institutional knowledge of the Company with considerable expertise in MRO services, parts distribution and aircraft and engine leasing sectors of the industry. |

Non-Employee Directors

Robert B. Nichols |

||

|

Age: 68 Position: Director |

|

Robert B. Nichols has served on our Board since December 2020. Mr. Nichols co-founded AerSale Corp. in 2008 with Mr. Finazzo and served as Vice Chairman from January 2019 until his retirement on December 31, 2023. He has also served as Division President, Asset Management Solutions from December 2019 until his retirement on December 31, 2023. From 2017 to December 2019, Mr. Nichols was Principal of AerSale Corp. From 2008 to 2017, Mr. Nichols also was Chief Operating Officer of AerSale Corp. From 1997 to 2008, prior to founding AerSale Corp., Mr. Nichols was Co-Founder and Chief Operating Officer of AeroTurbine, Inc. From 1990 to 1997, he was Vice President of Engine Sales and Leasing for AeroThrust, Inc. From 1989 to 1990, Mr. Nichols was Director of Engine Sales and Leasing for Greenwich Air Services. Mr. Nichols graduated from the University of Texas with a Bachelor of Science degree in business administration and accounting and attended vocation and technical training at Boeing (formerly Aviall Baniff) on a variety of aircraft engines, including P&WJT8D, CFMI, CFM56-3, IAE V2500, and RR Tay 650 heavy maintenance. As one of our founders and former Vice Chairman, Mr. Nichols brings to the Board significant senior leadership, marketing, technical, and global experience along with deep institutional knowledge of the Company, its operations and customer relations. |

AerSale, Inc. | 10

PROPOSALS TO BE VOTED ON

Lt. General Judith Fedder |

||

|

Age: 67 Position: Director |

|

Lt. General Fedder has served on our Board since July 1, 2022. At the time of her retirement after nearly 35 years of active duty Air Force service, Lt. General Fedder served as Deputy Chief of Staff for Logistics, Installations and Mission Support, Headquarters U.S. Air Force, Washington, D.C. In that role, she was responsible to the Air Force Chief of Staff for leadership, management and integration of Air Force logistics readiness, aircraft, munitions, and missile maintenance, with emphasis on combat readiness and weapon system availability. Her portfolio also included setting policy and preparing budget estimates for Air Force civil engineering and security forces functions. Following her military career, Lt. General Fedder was a Senior Director at The Boeing Company for Global Sales and Marketing, Integrated Logistics, Boeing Defense. In that role, she secured capture of after-market services for military fighter and helicopter platforms and supply chain. She is currently a Senior Advisor at the Boston Consulting Group. Lt. General Fedder is a member of the Board of Directors of GelSight, Inc. and the Institute for Defense & Business, a nonprofit education and research institute in Chapel Hill, North Carolina. She also served as a member of the Defense Advisory Committee for Women in the Services and is an Emeritus Member of the Board of Governors for Civil Air Patrol. General Fedder is a former Presidential appointee to the Board of Visitors for the U.S. Air Force Academy as well as recipient of the Michigan State University Distinguished Alumni Award in 2014. Lt. General Fedder graduated from Michigan State University in 1980 with a Bachelor of Science degree and holds an MBA from the Florida Institute of Technology. She is also a distinguished graduate of the Air Force Reserve Officer Training Corps program, and her active duty career included leading and commanding aircraft maintenance units. Lt. General Fedder served as the Sub-Unified Commander of U.S. Forces Azores and commanded the 76th Maintenance Wing aircraft depot at Tinker AFB, Oklahoma, leading over 9,000 employees in the maintenance, repair, and overhaul of military aircraft, engines, and components. Lt. General Fedder brings to the Board over 35 years of leadership and governance experience in aeronautical government and defense contracting and logistics.

|

AerSale, Inc. | 11

PROPOSALS TO BE VOTED ON

Andrew Levy |

||

|

Age: 55 Position: Director |

|

Mr. Levy has served on our Board since April 15, 2023. Mr. Levy is the founder, Chairman and Chief Executive Officer of Avelo, Inc. and its wholly owned subsidiary Avelo Airlines, an ultra-low-cost carrier focused on the U.S. domestic market. Prior to launching Avelo Airlines in 2021, Mr. Levy was a co-founder and served as President, Chief Operating Officer, Chief Financial Officer, Treasurer and a member of the board of directors of Allegiant Travel Company (Nasdaq: ALGT), parent company of U.S. ultra-low-cost carrier of Allegiant Air, from 2001 to 2014. Following his tenure at Allegiant, Mr. Levy served as Executive Vice President and Chief Financial Officer for United Airlines (NYSE: UAL) from August 2016 until May 2018. Mr. Levy has been a member of the board of directors at Copa Holdings, S.A. (NYSE: CPA) since 2016, a leading Latin American airline, and has served on its audit committee. Mr. Levy started his aviation career as the Director of Contracts at ValueJet Airlines and also served as Vice President of Savoy Capital, an aviation focused investment and advisory firm, and Vice President of Network Development and Planning at Mpower Communications, a telecommunications company. Mr. Levy earned a BA degree in Economics from Washington University in St. Louis and a Juris Doctorate degree from Emory University School of Law. Mr. Levy brings to the Board just under three decades of corporate and entrepreneurial experience in the aviation and telecommunications industries as well as leadership and governance experience and extensive involvement serving as a director and member of board committees. |

Thomas Mullins |

||

|

Age: 60 Position: Director |

|

Thomas Mullins was appointed to the AerSale Board on February 18, 2025. Mr. Mullins is currently an independent investor, including multiple private equity investments in the airline and aviation services sector. From 1990 until his retirement in June 2022, he was an investment banker at Raymond James Financial (“Raymond James”, NYSE: RJF). In 2000, he founded the aviation sector investment banking practice within Raymond James, which completed transactions for a range of clients in The Americas and Europe, including low-cost air carriers, full-service airlines, cargo airlines, regional “feeder” airlines, fixed-base operators, charter airlines, loyalty programs and others. His transaction work for aviation clients included IPOs and other types of public securities offerings, private equity and debt capital raises, mergers & acquisitions, and other advisory roles.

|

AerSale, Inc. | 12

PROPOSALS TO BE VOTED ON

Carol DiBattiste |

||

|

Age: 73 Position: Director |

|

Ms. DiBattiste was appointed to the Board on April 1, 2025. Ms. DiBattiste served as the Chief Legal & Compliance Officer and Corporate Secretary for QOMPLX, the principal business of which involved cloud-native risk analytics management, from 2021 to 2022. Prior to her position with QOMPLX, Ms. DiBattiste was employed by Comscore (Nasdaq:SCOR), a media measurement company providing marketing data and analytics to enterprises, as its Executive Vice President, Chief Legal Officer & Compliance Officer and Corporate Secretary, from 2019 to 2020, and its General Counsel & Chief Compliance, Privacy, People Officer & Secretary, from, 2017 to 2019. Ms. DiBattiste also served in senior executive positions including as the Executive Vice President, Chief Legal, Privacy, Security and Administrative Officer for Education Management Corporation (Nasdaq: EDMC), from 2013 to 2016; Executive Vice President, General Counsel and Chief Administrative Officer for GeekNet (Nasdaq: GKNT), from 2011 to 2013; Senior Vice President, Privacy and Security for Reed Elsevier/LexisNexis (NYSE: RELX), from 2008 to 2011; and Executive Vice President, General Counsel and Chief Privacy Officer at ChoicePoint (NYSE:CPS), from 2005 to 2008. Ms. DiBattiste's U.S. government senior executive experience includes: Highly Qualified Expert, Department of Defense (2023-2024); Executive in Charge and Vice Chairman, Board of Veterans’ Appeals (2016-2017), and Senior Advisor for Appeals Modernization, Office of the Secretary (2016), Department of Veterans Affairs; Deputy Administrator (2004-2005), and Chief of Staff (2003-2004), Transportation Security Administration, Department of Homeland Security; Honorable Under Secretary of the United States Air Force (Senate confirmed), Department of Defense (1999-2001); Deputy United States Attorney, Southern District of Florida (1997-1999), and Director, Executive Office for U.S. Attorneys (1994-1997), Department of Justice; and Principal Deputy General Counsel of the Navy (1993-1994), Department of Defense. Ms. DiBattiste also served on active duty in the U.S. Air Force with a distinguished military career. Ms. DiBattiste previously served as an independent director on the board of directors of the following publicly traded companies: AEye (Nasdaq:LIDR), a provider of high-performance active LiDAR systems for vehicle autonomy, from 2021 to 2023, where she served as board chair and as a member of its audit, compensation and nominating and governance committees; and Climb Global Solutions (Nasdaq: CLMB), an information technology distribution and solutions provider, from 2020 to 2021. She also served on the board of directors of artificial intelligence provider Giant Oak, Inc.; and American Roll-On Roll-Off Carrier, a leading U.S. flag transportation carrier in the international trades. Ms. DiBattiste holds a Master of Laws Degree from the Columbia University School of Law, a Law Degree from Temple University School of Law, and a Bachelor of Arts Degree with honors from LaSalle University. She completed the Harvard Business School Strategic Leadership Program, Carnegie Mellon University Cybersecurity Oversight Certification, and was National Association of Corporate Directors NACD Directorship Certified. She is licensed to practice law in Florida and the District of Columbia, holds a Secret Level National Security Clearance, and is a speaker on Risk, Compliance, and Leadership. Ms. DiBattiste brings to the Board extensive experience in corporate governance, regulatory compliance, cybersecurity, and leadership roles across both the public and private sectors, including extensive executive positions at multiple public companies. |

AerSale, Inc. | 13

PROPOSALS TO BE VOTED ON

Thomas Mitchell |

||

|

Age: 54 Position: Director |

|

Mr. Mitchell served as the Chief Procurement Officer for Akumin, a leader in advanced imaging and radiation oncology in the U.S., from February 2024 to February 2025. Prior to his employment with Akumin, Mr. Mitchell was President at iAero Thrust, an integrated full-service provider of aftermarket power and maintenance for commercial jet engines, from February 2020 to January 2023. Prior to iAero Thrust, Mr. Mitchell held numerous positions at GE Healthcare, a leading global medical technology, pharmaceutical diagnostics, and digital solutions innovator, including as Chief Procurement Officer February 2019 to November 2019, Vice President of Global Supply Chain February 2018 to February 2019, and Vice President of Sourcing from 2015 to 2018. Mr. Mitchell also held a variety of positions at various GE entities (GE India, GE Inspection Technologies, GE Transportation, GE China, GE Aviation, GE Engine Assembly) including General Manager of Supply Chain, General Manager of Sourcing, Commodity Leader, Plant Operations Leader and Operational Development. Mr. Mitchell holds an MBA from the University of North Carolina and a BS in Manufacturing Engineering from Boston University. Mr. Mitchell brings to the Board particular knowledge and experience in the areas of global supply chain management, manufacturing, aviation, strategic acquisitions and engineering. He also brings familiarity with the Company’s customer base and feedstock sources, and with the commercial aviation sector generally. |

AerSale, Inc. | 14

PROPOSALS TO BE VOTED ON

PROPOSAL 2: APPROVAL OF SECOND AMENDMENT TO AERSALE CORPORATION 2020 EQUITY INCENTIVE PLAN

Proposal Summary

Effective as of December 22, 2020, the Company established the AerSale Corporation 2020 Equity Incentive Plan (the “2020 Plan”). The 2020 Plan is a vehicle through which Company directors, officers, employees, consultants, and advisors can acquire and maintain an equity interest in the Company through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, and other equity-based awards, or be paid incentive compensation, including incentive compensation measured by reference to the value of the Company’s common stock, thereby strengthening their commitment to the Company’s success and aligning their interests with those of the Company’s stockholders.

On June 9, 2023, the First Amendment to the 2020 Plan was approved by the Company’s stockholders at the Company’s 2023 Annual Meeting of Stockholders to increase the number of shares of common stock reserved and available for grant under the 2020 Plan by 2,000,000 shares, for a total of 6,200,000 shares reserved and available for grant.

On April 21, 2025 (the “Amendment Effective Date”), the Board adopted, subject to stockholder approval, the Second Amendment to the 2020 Plan (the “Second Amendment”). If approved by the stockholders, the Second Amendment will (i) increase the number of shares of common stock reserved and available for grant under the 2020 Plan by 4,000,000 shares. No other changes are being made to the 2020 Plan. The Board believes that the Company’s success is due to its talented workforce and that its future success partially depends on the Company’s continued ability to attract and retain talented people, and (ii) increase from $300,000 to $325,000 the aggregate total compensation awarded to a non-employee director during any fiscal year. The ability to grant equity awards under the 2020 Plan is a critical tool in the Company’s efforts to achieve this objective.

We believe that equity-based awards are an important part of our overall compensation program and want to ensure that there is a sufficient number of shares available to adequately incentivize our officers, employees, directors and consultants. As of December 31, 2024, we had 1,380,277 shares of restricted stock units (including both time-based RSUs (as defined below) and PSUs (as defined below)) and 646,301 stock options outstanding under the 2020 Plan. As of December 31, 2024, only 1,294,229 shares remained available for future grants under the 2020 Plan.

If the Second Amendment is not approved, the shares available for grant under the 2020 Plan could be exhausted within the next year, which would have a detrimental effect on our ability to attract, retain and motivate our employees, officers, directors, advisors and consultants.

Our burn rate for the last two years (the “Burn Rate”), which we define as the total number of shares subject to awards granted in a calendar year expressed as a percentage of our diluted weighted average shares outstanding, was 3% for 2024 and 1% for 2023, and the average Burn Rate over the last two years was 2%. The Board believes that the potential dilution from equity issuances to be made under the 2020 Plan, approval of the Second Amendment, and our historical Burn Rate is reasonable and that approval of the Second Amendment is in the best interests of our stockholders as it allows us to continue awarding equity incentives, which are an important component of our overall compensation program.

In addition to reasonable Burn Rate and dilution levels, we note that our 2020 Plan incorporates the following corporate governance features, which we believe protect the best interests of our stockholders:

AerSale, Inc. | 15

PROPOSALS TO BE VOTED ON

The closing price of our common stock, as reported on the NASDAQ on April 9, 2025 was $7.35 per share. If the Second Amendment is approved by our stockholders, we anticipate filing a Form S-8 registration statement with the SEC shortly after the Annual Meeting to register the additional shares authorized for issuance pursuant to the Second Amendment.

Set forth below is a summary of the principal provisions of the 2020 Plan, as amended by the proposed Second Amendment. The summary is qualified by reference to the full text of 2020 Plan, as amended by the First Amendment and the proposed Second Amendment.

Plan Summary

Purpose. The purpose of the 2020 Plan is to attract and retain key personnel by providing a vehicle through which Company directors, officers, employees, consultants, and advisors can acquire and maintain an equity interest through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, and other equity-based awards, or be paid incentive compensation, including incentive compensation measured by reference to the value of the Company’s common stock, thereby strengthening their commitment to the Company’s success and aligning their interests with those of the Company’s stockholders.

Eligible Participants. Any director, officer, employee, advisor or consultant of the Company or its affiliates will be eligible to participate in the 2020 Plan. We currently have approximately 621 employees and eight non-employee directors, although we expect that the majority of awards will be generally limited to approximately 20 employees and all of our non-employee directors.

Types of Awards. The 2020 Plan provides for the grant of options to purchase shares of our common stock, $0.0001 par value (“Shares”), including stock options intended to qualify as incentive stock options (“ISOs”) under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”) and nonqualified stock options that are not intended to so qualify (“NQSOs”), stock appreciation rights (“SARs”), restricted stock awards and restricted stock units (“RSUs”), and other equity-based or cash-based awards (each, an “Award”).

Administration. The 2020 Plan will be administered by the Compensation Committee of the Board or such other committee as the Board may designate to administer the 2020 Plan (the “Compensation Committee”). Subject to the terms of the 2020 Plan and applicable law, the Compensation Committee will have the sole authority to: (i) designate participants; (ii) determine the type or types of Awards to be granted; (iii) determine the number of Shares to be covered by, or with respect to which payments, rights, or other matters are to be calculated in connection with, Awards; (iv) determine the terms and conditions of any Award; (v) determine whether, to what extent, and under what circumstances Awards may be settled in, or exercised for, cash, Shares, other securities, other Awards, or other property, or canceled, forfeited, or suspended and the method or methods by which Awards may be settled, exercised, canceled, forfeited, or suspended; (vi) determine whether, to what extent, and under what circumstances the delivery of cash, Shares, other securities, other Awards, or other property and other amounts payable with respect to an Award shall be deferred either automatically or at the election of the participant or of the Compensation Committee; (vii) interpret, administer, reconcile any inconsistency in, correct any defect in, and/or supply any omission in the 2020 Plan and any instrument or agreement relating to, or Award granted under, the 2020 Plan; (viii) establish, amend, suspend, or waive any rules and regulations and appoint such agents as the Compensation Committee shall deem appropriate for the proper administration of the 2020 Plan; and (ix) make any other determination and take any other action that the Compensation Committee deems necessary or desirable for the administration of the 2020 Plan. Unless otherwise expressly provided in the 2020 Plan, all designations, determinations, interpretations, and other decisions under or with respect to the 2020 Plan

AerSale, Inc. | 16

PROPOSALS TO BE VOTED ON

or any award or any documents evidencing awards granted pursuant to the 2020 Plan are within the sole discretion of the Compensation Committee, may be made at any time, and are final, conclusive, and binding upon all persons or entities

Share Reserve. Subject to adjustment as provided below, if the Second Amendment is approved, the maximum aggregate number of Shares that may be delivered pursuant to Awards granted under the 2020 Plan will be 10,200,000 shares (the “Absolute Share Limit”). To the extent that an Award expires or is cancelled, forfeited, terminated, settled in cash, or otherwise is settled without issuance to the participant of the full number of Shares to which the Award related, the unissued Shares will again be available for grant under the 2020 Plan. Shares withheld or surrendered in payment of the exercise price, or taxes relating to an Award, shall be deemed to constitute Shares not issued; provided, however, that such Shares shall not become available for issuance if either: (i) the applicable Shares are withheld or surrendered following the termination of the 2020 Plan; or (ii) at the time the applicable Shares are withheld or surrendered, it would constitute a material revision of the 2020 Plan subject to stockholder approval under any then-applicable rules of the national securities exchange on which the Shares are listed. Awards may, in the sole discretion of the Compensation Committee, be granted in assumption of, or in substitution for, outstanding awards previously granted by an entity directly or indirectly acquired by the Company or with which the Company combines, or substitute awards, and such substitute awards will not be counted against the Absolute Share Limit, except that substitute awards intended to qualify as ISOs will count against the limit on ISOs described below.

Other Plan Limits. The maximum aggregate number of Shares in the Share Pool that may be issued pursuant to ISOs is 10,200,000 (the “ISO Limit”).

Limit for Non-Employee Directors. During a single fiscal year, each non-employee director shall be granted a number of Shares, taken together with any cash fees paid to such non-employee director during the fiscal year, equal to a total value of $325,000 or such lower amount as determined by the Board.

Changes in Capitalization. In the event of (i) any dividend (other than regular cash dividends) or other distribution (whether in the form of cash, Shares, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, split-off, spin-off, combination, repurchase, or exchange of Shares or other securities of the Company, issuance of warrants or other rights to acquire Shares or other securities of the Company, or other similar corporate transaction or event that affects the Shares (including a Change in Control (as defined in the 2020 Plan)); or (ii) unusual or nonrecurring events affecting the Company, including changes in applicable rules, rulings, regulations, or other requirements, that the Compensation Committee determines, in its sole discretion, could result in dilution or enlargement of the rights intended to be granted to, or available for, participants (any event in (i) or (ii), an “Adjustment Event”), the Compensation Committee shall, in respect of any such Adjustment Event, make such proportionate substitution or adjustment, if any, as it deems equitable, to any or all of: (A) the Absolute Share Limit, or any other limit applicable under the 2020 Plan with respect to the number of Awards which may be granted hereunder; (B) the number of Shares or other securities of the Company (or number and kind of other securities or other property) which may be issued in respect of Awards or with respect to which Awards may be granted under the 2020 Plan; and (C) the terms of any outstanding Award, including, without limitation: (I) the number of Shares or other securities of the Company (or number and kind of other securities or other property) subject to outstanding Awards or to which outstanding Awards relate; (II) the exercise price or strike price with respect to any Award; or (III) any applicable performance measures; provided, that in the case of any “equity restructuring” (within the meaning of the Financial Accounting Standards Board Accounting Standards Codification Topic 718 (or any successor pronouncement thereto)), the Compensation Committee shall make an equitable or proportionate adjustment to outstanding Awards to reflect such equity restructuring.

Description of Awards

Stock Options. A stock option is a right to purchase Shares in the future at an exercise price determined by the Compensation Committee at the date of grant. The per-Share exercise price for stock options will not be less than the Fair Market Value (as defined in the 2020 Plan) on the date of grant (and not less than 110% of such Fair

AerSale, Inc. | 17

PROPOSALS TO BE VOTED ON

Market Value for ISO grants made to holders of more than 10% of the Company’s voting power). The terms and conditions of stock options (including exercise price and vesting) will be determined by the Compensation Committee subject to limits set forth in the 2020 Plan and as set forth in the applicable award agreement. All stock options granted under the 2020 Plan will be NQSOs unless the applicable award agreement expressly states that the stock option is intended to be an ISO. All terms and conditions of all grants of ISOs will be subject to Section 422 of the Code and the regulations promulgated thereunder. The maximum term for an option is 10 years from the date of grant. Unless otherwise provided by the Compensation Committee, the purchase price for the Shares as to which a stock option is exercised may be paid to the Company, to the extent permitted by law: (i) in cash, check, cash equivalent, and/or Shares valued at the Fair Market Value at the time the option is exercised; provided, that such Shares are not subject to any pledge or other security interest and have been held by the participant for at least six months; or (ii) by such other method as the Compensation Committee may permit in its sole discretion, including, without limitation: (a) in other property having a Fair Market Value on the date of exercise equal to the exercise price; (b) if there is a public market for the Shares at such time, by means of a broker-assisted “cashless exercise” pursuant to which the Company is delivered (including telephonically to the extent permitted by the Compensation Committee) a copy of irrevocable instructions to a stockbroker to sell the Shares otherwise issuable upon the exercise of the option and to deliver promptly to the Company an amount equal to the exercise price; or (c) a “net exercise” procedure effected by withholding the minimum number of Shares otherwise issuable in respect of an option that is needed to pay the exercise price.

SARs. The Compensation Committee may grant SARs under the 2020 Plan, with terms and conditions determined by the Compensation Committee that are not inconsistent with the 2020 Plan. The Compensation Committee may award SARs in tandem with options, and may also award SARs independent of any option. Generally, each SAR will entitle the participant upon exercise to an amount (in cash, Shares or a combination of cash and Shares, as determined by the Compensation Committee) equal to the product of (i) the excess of (a) the fair market value on the exercise date of one Share over (b) the strike price per Share covered by the SAR, times (ii) the number of Shares covered by the SAR, less any taxes required to be withheld. The strike price per Share will be determined by the Compensation Committee at the time of grant but in no event may such amount be less than 100% of the Fair Market Value of a Share on the date the SAR is granted.

Restricted Stock. A share of restricted stock will be an actual Share granted under the 2020 Plan that will be subject to certain transfer restrictions, forfeiture provisions and/or other terms and conditions specified in the 2020 Plan and in the applicable award agreement. The terms and conditions of restricted shares will be determined by the Compensation Committee and set forth in the applicable award agreement, including the vesting schedule, vesting criteria (including any performance goals), term and methods and form of settlement. Restricted shares will be evidenced in such manner as the Compensation Committee may determine. If certificates representing restricted stock are registered in the name of the applicable participant, the certificates will bear an appropriate legend referring to the terms, conditions and restrictions applicable to restricted stock, and the Company will, at its discretion, retain physical possession of the certificates until all applicable restrictions lapse.

RSUs. An RSU is an unfunded and unsecured promise to deliver Shares or cash, or a combination, in accordance with the terms of the applicable award agreement. Each RSU will be granted with respect to a specified number of Shares (or a number of Shares determined pursuant to a specified formula) or will have a value equal to the Fair Market Value of a specified number of Shares (or a number of Shares determined pursuant to a specified formula). RSUs will be permitted to be settled in cash, Shares or any combination thereof, upon the lapse of restrictions applicable to such RSUs or in accordance with the applicable award agreement. The terms and conditions of RSUs will be determined by the Compensation Committee and set forth in the applicable award agreement, including the vesting schedule, vesting criteria (including any performance goals), term and methods and form of settlement.

Other Equity-Based Awards and Other Cash-Based Awards. The Compensation Committee may grant other equity-based or cash-based awards under the 2020 Plan, with terms and conditions determined by the Compensation Committee that are not inconsistent with the 2020 Plan.

Dividends and Dividend Equivalent Rights. The Compensation Committee in its sole discretion may provide as part of an award dividends or dividend equivalents, on such terms and conditions as may be determined by the

AerSale, Inc. | 18

PROPOSALS TO BE VOTED ON

Compensation Committee in its sole discretion. Any dividends payable in respect of restricted stock awards that remain subject to vesting conditions shall be retained by the Company and delivered to the participant within 15 days following the date on which such restrictions on such restricted stock awards lapse and, if such restricted stock is forfeited, the participant shall have no right to such dividends. To the extent provided in an award agreement, dividends attributable to RSUs shall be distributed to the participant in cash or, in the sole discretion of the Compensation Committee, in Shares, upon the settlement of the RSUs and, if such RSUs are forfeited, the participant shall have no right to such dividends.

Description of Other 2020 Plan Terms

Term. No Award may be granted under the 2020 Plan after the tenth anniversary of the Effective Date (as defined in the 2020 Plan) but awards granted before then may extend beyond that date.

Amendment and Termination. The Board may amend, alter, suspend, discontinue, or terminate the 2020 Plan or any portion thereof at any time; provided, that no such amendment, alteration, suspension, discontinuance, or termination may be made without stockholder approval if: (i) such approval is necessary to comply with any regulatory requirement applicable to the 2020 Plan or for changes in U.S. GAAP to new accounting standards; (ii) it would increase the number of Shares which may be issued under the 2020 Plan (except for adjustments in connection with certain corporate events); or (iii) it would materially modify the requirements for participation in the 2020 Plan; provided, further, that any such amendment, alteration, suspension, discontinuance, or termination that would materially and adversely affect the rights of any participant or any holder or beneficiary of any award will not to that extent be effective without such individual’s consent.

The Compensation Committee may, to the extent consistent with the terms of any applicable award agreement, waive any conditions or rights under, amend any terms of, or alter, suspend, discontinue, cancel, or terminate, any award granted or the associated award agreement, prospectively or retroactively (including after a termination of employment or service); provided, that, except as otherwise permitted in the 2020 Plan, any such waiver, amendment, alteration, suspension, discontinuance, cancellation, or termination that would materially and adversely affect the rights of any participant with respect to such award will not to that extent be effective without such individual’s consent.

No Repricing. Without stockholder approval, except as otherwise permitted in the 2020 Plan: (i) no amendment or modification may reduce the exercise price of any option or the strike price of any SAR; (ii) the Compensation Committee may not cancel any outstanding option or SAR and replace it with a new option or SAR (with a lower exercise price or strike price, as the case may be) or other award or cash payment that is greater than the intrinsic value of the cancelled option or SAR; and (iii) the Compensation Committee may not take any other action which is considered a “repricing” for purposes of the stockholder approval rules of any securities exchange or inter-dealer quotation system on which the Company’s securities are listed or quoted.

Clawback/Repayment. All awards are subject to reduction, cancellation, forfeiture, or recoupment to the extent necessary to comply with: (i) any clawback, forfeiture, or other similar policy adopted by the Board or the Compensation Committee and as in effect from time to time including, without limitation, the AerSale Corporation Clawback Policy adopted effective December 1, 2023; and (ii) applicable law. To the extent that a participant receives any amount in excess of the amount that the participant should otherwise have received under the terms of the award for any reason (including, without limitation, by reason of a financial restatement, mistake in calculations, or other administrative error), the participant will be required to repay the Company any such excess amount.

Detrimental Activity. If a participant has engaged in any Detrimental Activity (as defined in the 2020 Plan), the Compensation Committee may, in its sole discretion, provide for one or more of the following: (i) cancellation of any or all of such participant’s outstanding awards; or (ii) forfeiture and repayment to the Company on any gain realized on the vesting, exercise, or settlement of any awards previously granted to such participant.

AerSale, Inc. | 19

PROPOSALS TO BE VOTED ON

Assignability. No award will be permitted to be assigned, alienated, pledged, attached, sold, or otherwise transferred or encumbered by a participant other than by will or by the laws of descent and distribution and any such purported assignment, alienation, pledge, attachment, sale, transfer or encumbrance will be void and unenforceable against the Company. However, the Compensation Committee may, in its sole discretion, permit awards (other than incentive stock options) to be transferred, including transfers to a participant’s family members, any trust established solely for the benefit of a participant or such participant’s family members, any partnership or limited liability company of which a participant, or such participant and such participant’s family members, are the sole member(s), and a beneficiary to whom donations are eligible to be treated as “charitable contributions” for tax purposes.

New Plan Benefits

The issuance of any awards under the 2020 Plan will be at the discretion of the Compensation Committee. Therefore, it is not possible to determine the number of shares that will be granted to any individual in the future. As discussed elsewhere in this proxy statement, pursuant to our current director compensation program, non-employee directors are granted an annual RSU award that has a grant date fair value of $125,000. Accordingly, we anticipate that in June 2025 our non-employee directors will be granted RSUs under the 2020 Plan with a value $125,000. In addition, on February 18, 2025, Mr. Mullins received a prorated annual RSU award of 5,434 units and it is anticipated that Ms. DiBattiste and Mr. Mitchell will each receive a prorated RSU award reflecting their service on the Board from April 1, 2025 through the Annual Meeting. The following table sets forth the number of stock options and RSU and PSU awards granted during 2024 under the 2020 Plan to: (i) all our named executive officers, individually and as a group; (ii) all current directors and director nominees who are not executive officers, individually and as a group; and (iii) all employees, including all current officers who are not executive officers, as a group.

|

|

Aggregate Restricted Stock Units and Performance Awards |

|

Stock Options |

|||

Individual or Group Name and Position |

|

Dollar Value |

Granted |

|

Dollar Value |

Granted |

Weighted Average Exercise Price per Share |

Named Executive Officers |

|

|

|

|

|

|

|

Nicolas Finazzo, Chairman and Chief Executive Officer |

|

$ 3,242,460 |

461,889 |

|

$ 1,081,141 |

289,850 |

$ 7.02 |

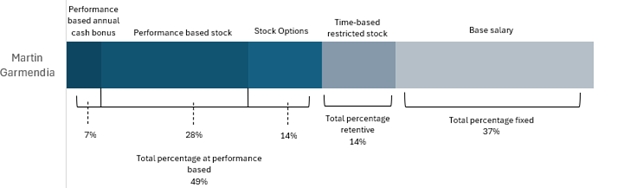

Martin Garmendia, Chief Financial Officer and Treasurer |

|

$ 459,340 |

65,433 |

|

$ 153,161 |

41,062 |

$ 7.02 |

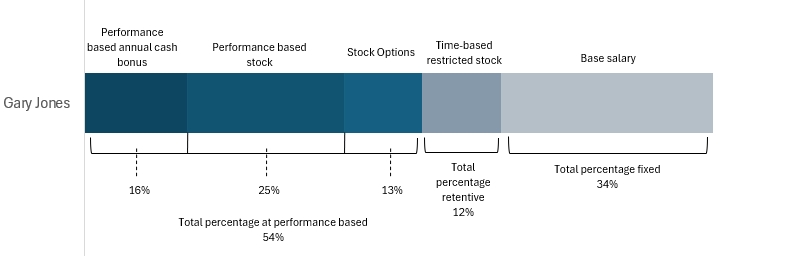

Gary Jones, Chief Operating Officer and Head of Material Sales |

|

$ 459,340 |

65,433 |

|

$ 153,161 |

41,062 |

$ 7.02 |

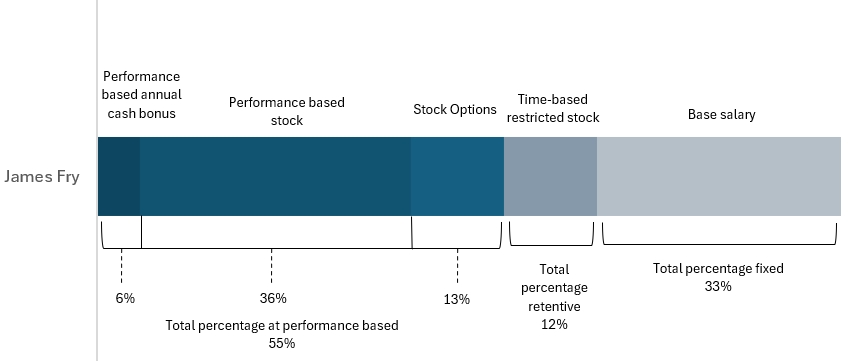

James Fry, Former EVP, General Counsel & Secretary(1) |

|

$ 563,011 |

80,201 |

|

$ 144,150 |

38,646 |

$ 7.02 |

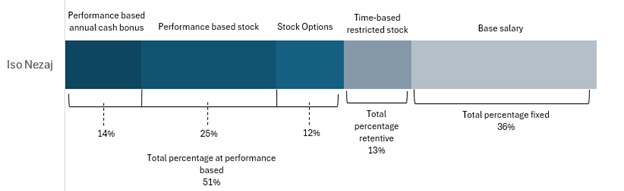

Iso Nezaj, Chief Product Development Officer |

|

$ 360,273 |

51,321 |

|

$ 120,125 |

32,205 |

$ 7.02 |

Executive Officer Group (eight persons) |

|

$ 5,984,367 |

852,474 |

|

$ 1,927,269 |

516,694 |

$7.02 |

Non-Executive Director Group |

|

|

|

|

|

|

|

Robert B. Nichols |

|

$ 177,158 |

21,354 |

|

— |

— |

— |

Lt. General Judith Fedder |

|

$ 125,000 |

16,960 |

|

— |

— |

— |

Andrew Levy |

|

$ 125,000 |

16,960 |

|

— |

— |

— |

AerSale, Inc. | 20

PROPOSALS TO BE VOTED ON

Jonathan Seiffer(2) |

|

— |

— |

|

— |

— |

— |

Thomas Mullins(3) |

|

— |

— |

|

— |

— |

— |

Carol DiBattiste(3) |

|

— |

— |

|

— |

— |

— |

Thomas Mitchell(3) |

|

— |

— |

|

— |

— |

— |

Peter Nolan |

|

$ 125,000 |

16,960 |

|

— |

— |

— |

General C. Robert Kehler |

|

$ 125,000 |

16,960 |

|

— |

— |

— |

Non-Executive Director Group (nine persons) |

|

$ 677,158 |

89,194 |

|

— |

— |

— |

Non-Executive Officer Employee Group (about 11 persons) |

|

$ 1,449,862 |

206,533 |

|

483,434 |

129,607 |

$7.02 |

Each associate of any such directors, executive officers or nominees |

|

— |

— |

|

— |

— |

— |

Each other person who received or is to receive 5% of such options or rights |

|

— |

— |

|

— |

— |

— |

|

(1)

Mr. Fry resigned from the Company on April 14, 2025.

(2)

Pursuant to Leonard Green internal policies, any directors affiliated with Leonard Green are not entitled to any form of Board compensation. Mr. Seiffer resigned from the Board effective March 14, 2025.

(3)

Mr. Mullins, Ms. DiBattiste and Mr. Mitchell were appointed to the Board during fiscal 2025 and accordingly did not receive any board compensation during fiscal 2024.

|

|||||||

U.S. Federal Income Tax Consequences

The United States federal income tax consequences of the issuance and/or exercise of option awards under the 2020 Plan are as follows. The summary is based on the law as in effect on December 31, 2024. The summary does not discuss state or local tax consequences or non-U.S. tax consequences.