DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on December 11, 2020

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

Monocle Acquisition Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | ||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ¨ | Fee paid previously with preliminary materials. | ||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

Monocle Acquisition Corporation

750 Lexington Avenue, Suite 1501

New York, New York 10022

NOTICE OF SPECIAL MEETING OF

STOCKHOLDERS OF MONOCLE ACQUISITION CORPORATION

To be reconvened on December 21, 2020

To the Stockholders of Monocle Acquisition Corporation:

The previously announced special meeting of stockholders (the “Special Meeting”) of Monocle Acquisition Corporation (“Monocle”) was originally convened on November 4, 2020 and adjourned, without conducting any business. Monocle previously sent a proxy statement and notice of Special Meeting to ask for your vote on important proposals related to Monocle’s previously announced proposed business combination (the “Business Combination”) with AerSale Corp., a Delaware corporation (“AerSale”).

NOTICE IS HEREBY GIVEN that Monocle will reconvene the Special Meeting on December 21, 2020, at 10:00 a.m., Eastern Time, at the offices of Cadwalader, Wickersham & Taft LLP, 200 Liberty Street, 39th Floor, New York, NY 10281. At the Special Meeting, the Company’s stockholders will vote on the proposals described in the proxy statement filed with the Securities and Exchange Commission on October 16, 2020 (the “Proxy Statement”), including the proposal to approve and adopt the Amended and Restated Plan of Merger, dated as of September 8, 2020, by and among Monocle and AerSale, among other affiliated parties, and the Business Combination. Detailed information about the Special Meeting and the proposal can be found in the Proxy Statement previously mailed to stockholders. Stockholders will also be able to obtain copies of the Proxy Statement and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www.sec.gov. We urge you to read carefully the Proxy Statement in its entirety, including the Annexes and accompanying financial statements of Monocle and AerSale.

The record date for the Special Meeting is December 1, 2020. Only stockholders of record at the close of business on that date may vote at the Special Meeting or any adjournment thereof. A proxy for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the meeting as specified.

Pursuant to the Monocle’s amended and restated certificate of incorporation (the “Monocle Charter”), we are providing our public stockholders with the opportunity to redeem, upon the consummation of the Business Combination, public shares then held by them for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account (the “Trust Account”) established in connection with our initial public offering (“IPO”), calculated as of two business days prior to the consummation of the Business Combination, including interest earned on the funds held in the Trust Account and not previously released to us to pay our franchise and income taxes, divided by the number of then outstanding public shares, subject to the limitations described herein. The per-share amount we will distribute to investors who properly redeem their public shares will not be reduced by the transaction expenses incurred in connection with the Business Combination. For illustrative purposes, as of September 30, 2020, the estimated per share redemption price would have been approximately $10.264. Public stockholders may elect to redeem their shares even if they vote “FOR” the Business Combination.

You will be entitled to receive cash for any public shares to be redeemed only if you:

(i) (a) hold public shares or (b) hold public shares through units and you elect to separate your units into the underlying public shares and public warrants prior to exercising your redemption rights with respect to the public shares; and

(ii) prior to 5:00 p.m., Eastern Time, on December 18, 2020, (a) submit a written request to Continental Stock Transfer & Trust Company, Monocle’s transfer agent (the “Transfer Agent”), that Monocle redeem your public shares for cash and (b) deliver your public shares to the Transfer Agent, physically or electronically through Depository Trust Company.

Holders of units must elect to separate the underlying public shares and public warrants prior to exercising redemption rights with respect to the public shares. Any demand for redemption, once made, may be withdrawn at any time until the deadline for exercising redemption requests and thereafter, with our consent, until the Closing.

A public stockholder, together with any of his, her or its affiliates or any other person with whom it is acting in concert or as a “group” (as defined under Section 13 of the Securities Exchange Act of 1934, as amended), will be restricted from redeeming in the aggregate his, her or its shares or, if part of such a group, the group’s shares, in excess of 15% of the shares of common stock included in the units sold in our IPO. We have no specified maximum redemption threshold under the Monocle Charter, other than the aforementioned 15% threshold, except that in no event will we redeem shares of our common stock in an amount that would cause our net tangible assets to be less than $5,000,001. Each redemption of public shares by our public stockholders will reduce the amount in our Trust Account. Holders of our outstanding public warrants do not have redemption rights in connection with the Business Combination. Unless otherwise specified, the information in this proxy statement/prospectus assumes that none of our public stockholders exercise their redemption rights with respect to their public shares.

Our Initial Stockholders, officers and other directors have agreed to vote any shares of Monocle common stock held by them (the “Founder Shares”) and any public shares purchased during or after our IPO in favor of the Business Combination. Currently, our Initial Stockholders own approximately 82.2% of our issued and outstanding shares of common stock, including all of the Founder Shares. Additionally, our Initial Stockholders, current officers and other current directors have agreed to waive their redemption rights with respect to any shares of our common stock they may hold in connection with the consummation of the Business Combination, and the Founder Shares will be excluded from the pro rata calculation used to determine the per-share redemption price.

The Business Combination is conditioned on the approval of certain proposals at the Special Meeting, as further described in the Proxy Statement. It is important for you to note that in the event that such proposals do not receive the requisite vote for approval, then Monocle will not consummate the Business Combination. In the event Monocle does not consummate the Business Combination and fails to complete an initial business combination by February 11, 2020, Monocle will be required to dissolve and liquidate the Trust Account by returning the then remaining funds in such account to the public stockholders. Monocle’s board of directors unanimously recommends that you vote “FOR” each of the proposals.

| By Order of the Board of Directors, | |

| /s/ Sai S. Devabhaktuni | |

| Sai S. Devabhaktuni Chairman of the Board of Directors |

|

| New York, New York December 11, 2020 |

This notice was mailed by Monocle on or about December 11, 2020.

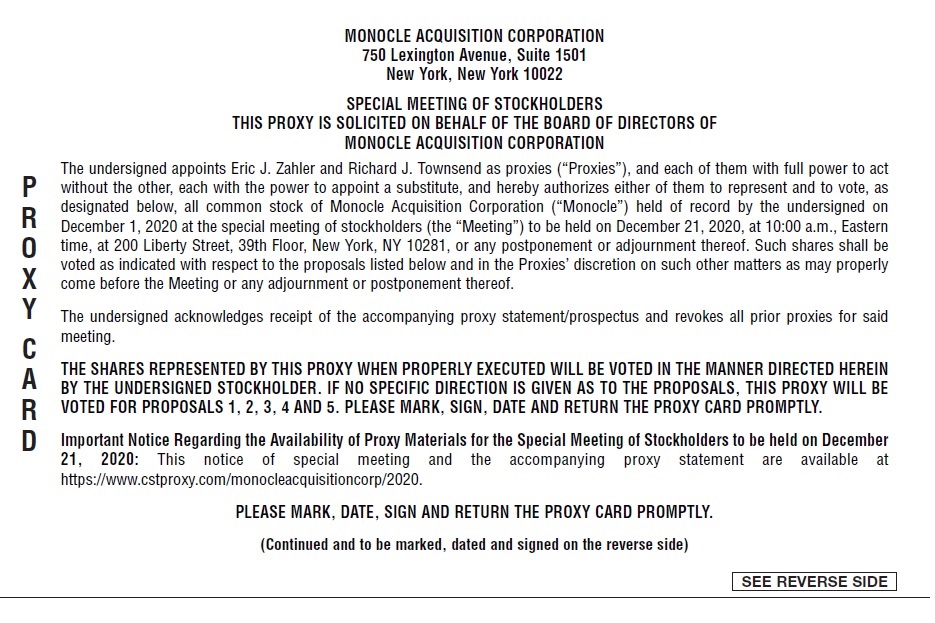

MONOCLE ACQUISITION CORPORATION 750 Lexington Avenue, Suite 1501 New York, New York 10022 SPECIAL MEETING OF STOCKHOLDERS THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF MONOCLE ACQUISITION CORPORATION The undersigned appoints Eric J. Zahler and Richard J. Townsend as proxies (“Proxies”), and each of them with full power to act without the other, each with the power to appoint a substitute, and hereby authorizes either of them to represent and to vote, as designated below, all common stock of Monocle Acquisition Corporation (“Monocle”) held of record by the undersigned on December 1, 2020 at the special meeting of stockholders (the “Meeting”) to be held on December 21, 2020, at 10:00 a.m., Eastern time, at 200 Liberty Street, 39th Floor, New York, NY 10281, or any postponement or adjournment thereof. Such shares shall be voted as indicated with respect to the proposals listed below and in the Proxies’ discretion on such other matters as may properly come before the Meeting or any adjournment or postponement thereof. The undersigned acknowledges receipt of the accompanying proxy statement/prospectus and revokes all prior proxies for said meeting. THE SHARES REPRESENTED BY THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO SPECIFIC DIRECTION IS GIVEN AS TO THE PROPOSALS, THIS PROXY WILL BE VOTED FOR PROPOSALS 1, 2, 3, 4 AND 5. PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY. Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on December 21, 2020: This notice of special meeting and the accompanying proxy statement are available at https://www.cstproxy.com/monocleacquisitioncorp/2020. PLEASE MARK, DATE, SIGN AND RETURN THE PROXY CARD PROMPTLY. (Continued and to be marked, dated and signed on the reverse side) P R O X Y C A R D

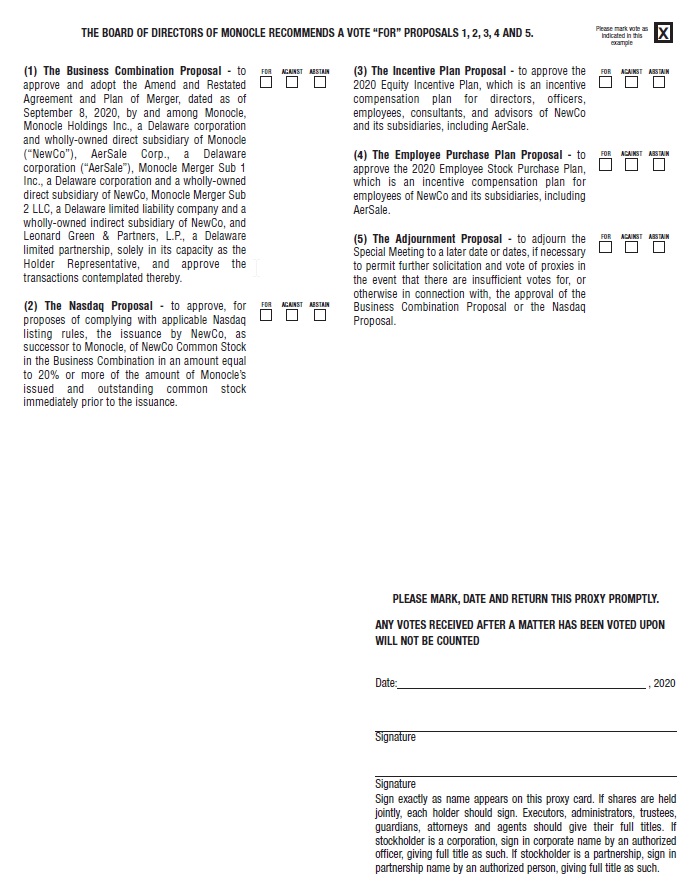

THE BOARD OF DIRECTORS OF MONOCLE RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, 4 AND 5. (1) The Business Combination Proposal - to approve and adopt the Amend and Restated Agreement and Plan of Merger, dated as of September 8, 2020, by and among Monocle, Monocle Holdings Inc., a Delaware corporation and wholly-owned direct subsidiary of Monocle (“NewCo”), AerSale Corp., a Delaware corporation (“AerSale”), Monocle Merger Sub 1 Inc., a Delaware corporation and a wholly-owned direct subsidiary of NewCo, Monocle Merger Sub 2 LLC, a Delaware limited liability company and a wholly-owned indirect subsidiary of NewCo, and Leonard Green & Partners, L.P., a Delaware limited partnership, solely in its capacity as the Holder Representative, and approve the transactions contemplated thereby. (2) The Nasdaq Proposal - to approve, for proposes of complying with applicable Nasdaq listing rules, the issuance by NewCo, as successor to Monocle, of NewCo Common Stock in the Business Combination in an amount equal to 20% or more of the amount of Monocle’s issued and outstanding common stock immediately prior to the issuance. (3) The Incentive Plan Proposal - to approve the 2020 Equity Incentive Plan, which is an incentive compensation plan for directors, officers, employees, consultants, and advisors of NewCo and its subsidiaries, including AerSale. (4) The Employee Purchase Plan Proposal - to approve the 2020 Employee Stock Purchase Plan, which is an incentive compensation plan for employees of NewCo and its subsidiaries, including AerSale. (5) The Adjournment Proposal - to adjourn the Special Meeting to a later date or dates, if necessary to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Business Combination Proposal or the Nasdaq Proposal. PLEASE MARK, DATE AND RETURN THIS PROXY PROMPTLY. ANY VOTES RECEIVED AFTER A MATTER HAS BEEN VOTED UPON WILL NOT BE COUNTED Date:, 2020 Signature Signature Sign exactly as name appears on this proxy card. If shares are held jointly, each holder should sign. Executors, administrators, trustees, guardians, attorneys and agents should give their full titles. If stockholder is a corporation, sign in corporate name by an authorized officer, giving full title as such. If stockholder is a partnership, sign in partnership name by an authorized person, giving full title as such.