EXHIBIT 99.1

Published on January 27, 2020

Exhibit 99.1

Monocle Acquisition Corporation AerSale Corp. Investor Presentation January 2020

2 No Offer or Solicitation This investor presentation (“Investor Presentation”) is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of Monocle Acquisition Corporation (“Monocle”) or AerSale Corp . (the “Company” or “AerSale”) or any of Monocle’s or AerSale’s affiliates . The Investor Presentation has been prepared to assist parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”), as contemplated in the Agreement and Plan of Merger (the “Merger Agreement”), of Monocle and AerSale and for no other purpose . It is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination . The information contained herein does not purport to be all - inclusive . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein . Any data on past performance or modeling contained herein is not an indication as to future performance . Monocle and AerSale assume no obligation to update the information in this Investor Presentation . Information contained in this Investor Presentation regarding Monocle has been provided by Monocle and information contained in this Investor Presentation regarding AerSale has been provided by AerSale . Use of Projections This Investor Presentation contains financial forecasts with respect to AerSale’s projected revenues, Adjusted EBITDA, the EBITDA bridge and free cash flow for AerSale’s fiscal years from 2019 to 2023 . Neither Monocle’s independent auditors, nor the independent registered public accounting firm of AerSale, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Investor Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Investor Presentation . These projections should not be relied upon as being necessarily indicative of future results . These projections are illustrative purposes only and should not be relied upon as being necessarily indicative of future results . In this Investor Presentation, certain of the above - mentioned projected information has been included (in each case, with an indication that the information is a projection or forecast), for purposes of providing comparisons with historical data . The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . Accordingly, there can be no assurance that the prospective results are indicative of the future performance of AerSale, Monocle, or the combined company after completion of the proposed Business Combination, or that actual results will not differ materially from those presented in the prospective financial information . Inclusion of the prospective financial information in this Investor Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved . Important Information About the Business Combination and Where to Find It In connection with the Business Combination, Monocle Holdings Inc . , the newly formed holding company that will become the parent of Monocle and AerSale at the closing of the Business Combination, filed with the SEC on December 31 , 2019 a Registration Statement on Form S - 4 , which included a preliminary proxy statement/prospectus of Monocle . When available, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to stockholders of Monocle as of a record date to be established for voting on the Business Combination . Monocle’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein filed in connection with the Business Combination, as these materials will contain important information about Monocle, AerSale and the Business Combination . Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the U . S . Securities and Exchange Commission (“SEC”) that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www . sec . gov, or by directing a request to : Monocle Acquisition Corporation, 750 Lexington Avenue, Suite 1501 , New York, NY 10022 . Participants in the Solicitation Monocle and its directors and executive officers may be deemed participants in the solicitation of proxies from Monocle’s stockholders with respect to the Business Combination . A list of the names of those directors and executive officers and a description of their interests in Monocle is contained in Monocle’s preliminary proxy statement, filed with the SEC on December 31 , 2019 and is available free of charge at the SEC’s web site at www . sec . gov, or by directing a request to Monocle Acquisition Corporation, 750 Lexington Avenue, Suite 1501 , New York, NY 10022 . Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the Business Combination when available . AerSale and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of AerSale in connection with the Business Combination . A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be included in the definitive proxy statement/prospectus for the Business Combination when available . Forward - Looking Statements This Investor Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . Monocle’s and AerSale’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events . Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements include, without limitation, Monocle’s and AerSale’s expectations with respect to future performance and anticipated financial impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination and the timing of the completion of the Business Combination . These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results . Most of these factors are outside Monocle’s and AerSale’s control and are difficult to predict . Factors that may cause such differences include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or could otherwise cause the Business Combination to fail to close ; ( 2 ) the outcome of any legal proceedings that may be instituted against Monocle and AerSale following the announcement of the Merger Agreement and the Business Combination ; ( 3 ) the inability to complete the Business Combination, including due to failure to obtain approvals from the stockholders of Monocle and AerSale or other conditions to closing in the Merger Agreement ; ( 4 ) the inability to obtain or maintain the listing of the shares of common stock of the post - acquisition company on The Nasdaq Stock Market following the Business Combination ; ( 5 ) the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the Business Combination ; ( 6 ) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees ; ( 7 ) costs related to the Business Combination ; ( 8 ) changes in applicable laws or regulations ; ( 9 ) the possibility that AerSale or the combined company may be adversely affected by other economic, business, and/or competitive factors ; and ( 10 ) other risks and uncertainties indicated from time to time in the proxy statement/prospectus relating to the Business Combination, including those under “Risk Factors” therein, and in Monocle’s other filings with the SEC . Monocle cautions that the foregoing list of factors is not exclusive . Monocle further cautions readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made . Monocle does not undertake to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based unless required to do so under applicable law . Important Notices and Disclaimers

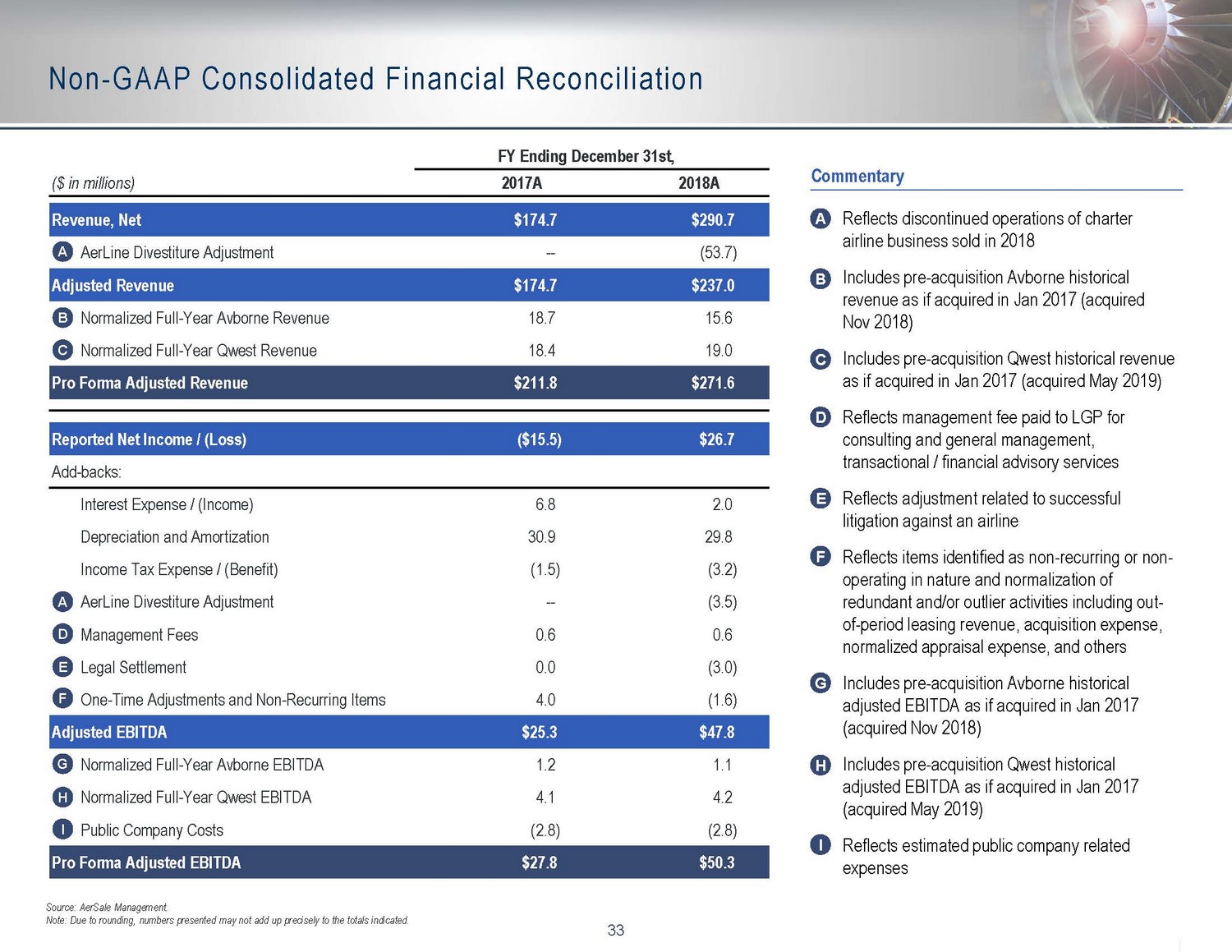

3 Industry and Market Data In this Investor Presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which AerSale competes and other industry data . We obtained this information and statistics from third - party sources, including reports by market research firms, and company filings . Non - GAAP Financial Measures This Investor Presentation includes non - GAAP financial measures, including Adjusted Revenue, Pro Forma Adjusted Revenue, Adjusted EBITDA and Pro Forma Adjusted EBITDA . AerSale defines Adjusted Revenue as revenue after giving effect to the AerLine Divested Revenue . AerSale defines Pro Forma Adjusted Revenue as Adjusted Revenue after giving effect to the Normalized Avborne Revenue and the Normalized Qwest Revenue . AerSale defines Adjusted EBITDA as net income (loss) after giving effect to interest expense, depreciation and amortization, income tax expense (benefit), management fees, the airline settlement and one - time adjustments and non - recurring items . AerSale defines Pro Forma Adjusted EBITDA as Adjusted EBITDA after giving effect to Normalized Avborne EBITDA, Normalized Qwest EBITDA and Public Company Costs . See Non - GAAP Financial Reconciliation on slide 33 . Monocle and AerSale believe that these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to AerSale’s financial condition and results of operations . AerSale’s management uses certain of these non - GAAP measures to compare AerSale’s performance to that of prior periods for trend analyses and for budgeting and planning purposes . A reconciliation of non - GAAP forward looking information to their corresponding GAAP measures has not been provided due to the lack of predictability regarding the various reconciling items such as provision for income taxes and depreciation and amortization, which are expected to have a material impact on these measures and are out of AerSale and Monocle’s control or cannot be reasonably predicted without unreasonable efforts . You should review AerSale’s audited financial statements, which are included in the proxy statement/prospectus to be delivered to Monocle’s stockholders, and not rely on any single financial measure to evaluate AerSale’s business . Other companies may calculate Adjusted Revenue, Pro Forma Adjusted Revenue, Adjusted EBITDA and Pro Forma Adjusted EBITDA differently, and therefore AerSale’s Adjusted Revenue, Pro Forma Adjusted Revenue, Adjusted EBITDA, Pro Forma Adjusted EBITDA and other non - GAAP measures may not be directly comparable to similarly titled measures of other companies . Important Notices and Disclaimers (Cont’d)

4 Table of Contents I. Introduction & Situation Overview II. Business Overview & Growth Opportunities III. Financial Detail & Transaction Summary IV. Appendix

Section I Introduction & Situation Overview

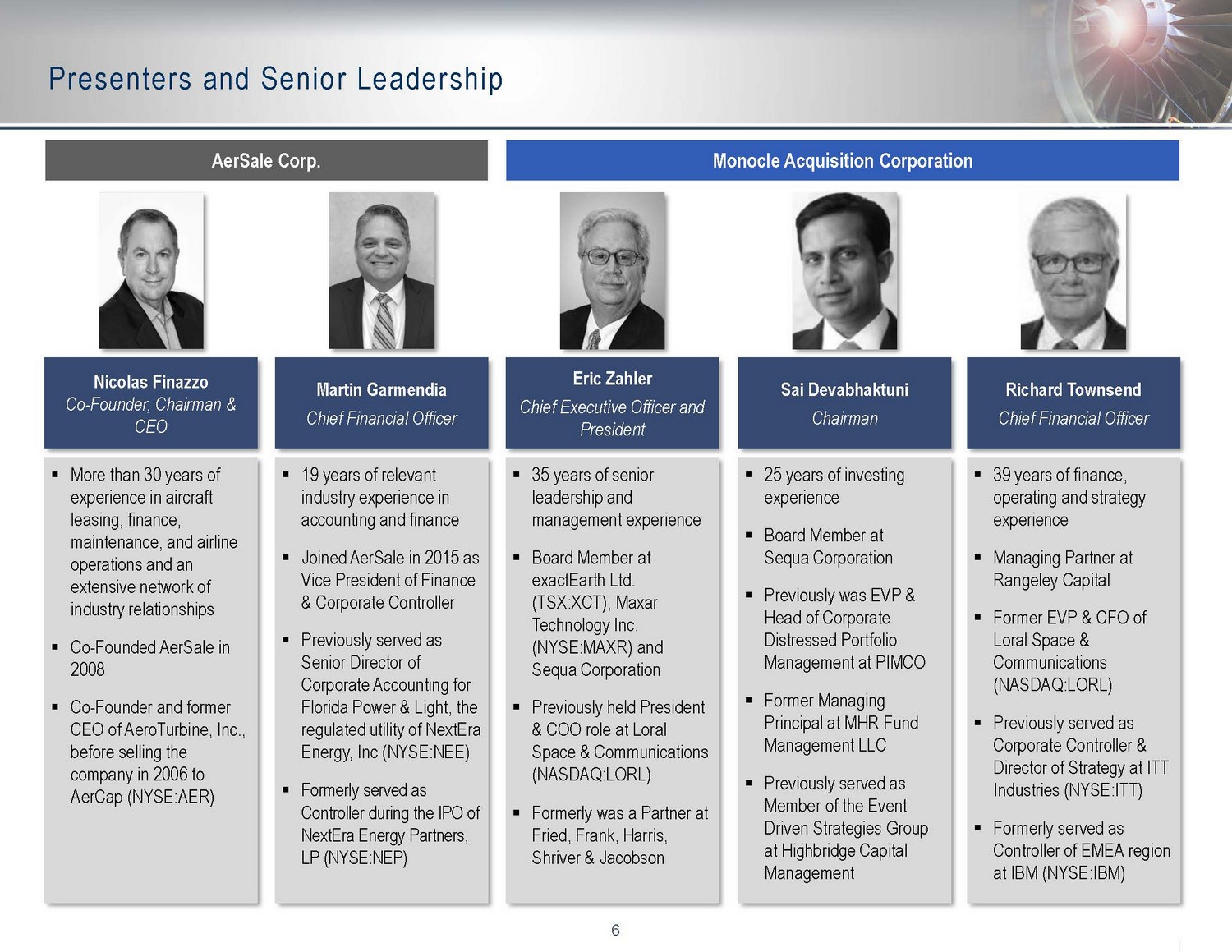

6 Presenters and Senior Leadership ▪ 35 years of senior leadership and management experience ▪ Board Member at exactEarth Ltd. (TSX:XCT), Maxar Technology Inc. (NYSE:MAXR) and Sequa Corporation ▪ Previously held President & COO role at Loral Space & Communications (NASDAQ:LORL) ▪ Formerly was a Partner at Fried, Frank, Harris, Shriver & Jacobson Eric Zahler Chief Executive Officer and President Sai Devabhaktuni Chairman ▪ 25 years of investing experience ▪ Board Member at Sequa Corporation ▪ Previously was EVP & Head of Corporate Distressed Portfolio Management at PIMCO ▪ Former Managing Principal at MHR Fund Management LLC ▪ Previously served as Member of the Event Driven Strategies Group at Highbridge Capital Management Richard Townsend Chief Financial Officer ▪ 39 years of finance, operating and strategy experience ▪ Managing Partner at Rangeley Capital ▪ Former EVP & CFO of Loral Space & Communications (NASDAQ:LORL) ▪ Previously served as Corporate Controller & Director of Strategy at ITT Industries (NYSE:ITT) ▪ Formerly served as Controller of EMEA region at IBM (NYSE:IBM) Monocle Acquisition Corporation ▪ 19 years of relevant industry experience in accounting and finance ▪ Joined AerSale in 2015 as Vice President of Finance & Corporate Controller ▪ Previously served as Senior Director of Corporate Accounting for Florida Power & Light, the regulated utility of NextEra Energy, Inc (NYSE:NEE) ▪ Formerly served as Controller during the IPO of NextEra Energy Partners, LP (NYSE:NEP) Martin Garmendia Chief Financial Officer ▪ More than 30 years of experience in aircraft leasing, finance, maintenance, and airline operations and an extensive network of industry relationships ▪ Co - Founded AerSale in 2008 ▪ Co - Founder and former CEO of AeroTurbine, Inc., before selling the company in 2006 to AerCap (NYSE:AER) Nicolas Finazzo Co - Founder, Chairman & CEO AerSale Corp.

7 Overview of Monocle, Leonard Green & Partners and Veritas Capital Monocle Acquisition Corporation (“Monocle”) (NASDAQ:MNCL) completed its IPO on February 11, 2019 for $172.5 million along with a private placement raise of $7.2 million at $10.00 per unit Background Sources: Company websites. (1) Indicates companies and organizations where Monocle management is currently a board member. (2) Represents prior SPAC transaction experience. Combined with Levy Acquisition Corp in 2015. Monocle Acquisition Corporation Leonard Green & Partners Eric Zahler, CEO and President Operating, Board, and Related Investing Experience (1) (1) (1) Richard Townsend, EVP and CFO Sai Devabhaktuni, Chairman (1) Background x Focus on Aerospace & Defense x Market leader, high barriers to entry, and defensible market position x Established management team x Platform for significant growth opportunities x EBITDA greater than $50 million Business Combination Criteria ~100 years of collective management experience 20 - year working relationship driving change and creating value Leonard Green & Partners (“LGP”) is a leading private equity firm founded in 1989 and headquartered in Los Angeles, CA Invested in 90+ companies since inception With $36B+ of capital raised since inception Selected Current & Past Portfolio Companies Strong Alignment of Interests Between Monocle, Leonard Green & Partners and Veritas Capital (2) Veritas Capital Veritas Capital is a leading private investment firm with more than 20 years of experience investing in the Aerospace & Defense industry and headquartered in New York, NY Completed $9B+ of acquisitions across 10 platforms and 33 add - on acquisitions in A&D industry Selected Current & Past Portfolio Companies Background

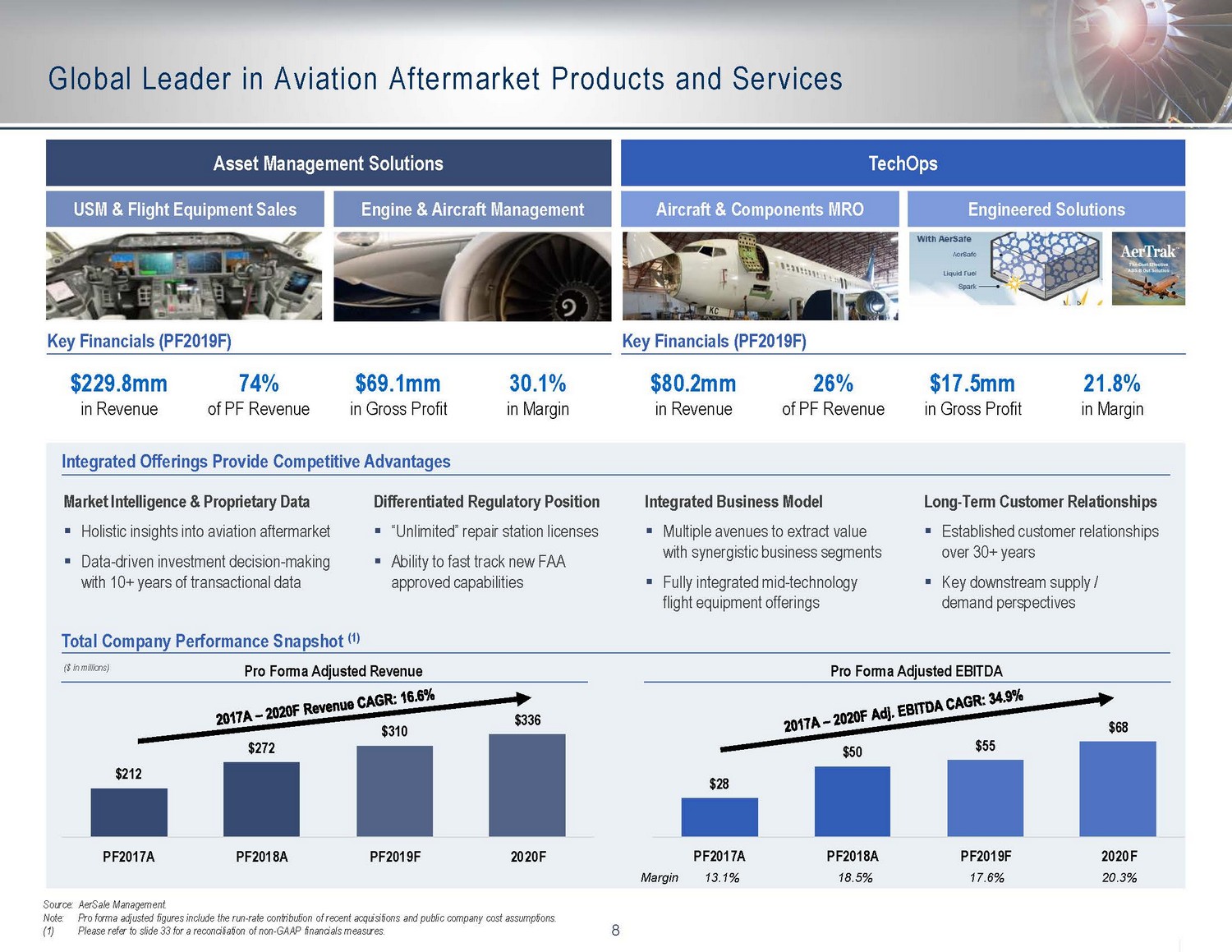

8 Global Leader in Aviation Aftermarket Products and Services Source: AerSale Management. Note: Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. (1) Please refer to slide 33 for a reconciliation of non - GAAP financials measures. Asset Management Solutions TechOps USM & Flight Equipment Sales Engine & Aircraft Management Aircraft & Components MRO Engineered Solutions Key Financials (PF2019F) $229.8mm in Revenue $69.1mm in Gross Profit 30.1% in Margin 74% of PF Revenue Key Financials (PF2019F) $80.2mm in Revenue $17.5mm in Gross Profit 21.8% in Margin 26% of PF Revenue Total Company Performance Snapshot (1) Pro Forma Adjusted Revenue ($ in millions) Pro Forma Adjusted EBITDA Margin 18.5% 17.6% 13.1% 20.3% Integrated Offerings Provide Competitive Advantages Market Intelligence & Proprietary Data ▪ Holistic insights into aviation aftermarket ▪ Data - driven investment decision - making with 10+ years of transactional data Integrated Business Model ▪ Multiple avenues to extract value with synergistic business segments ▪ Fully integrated mid - technology flight equipment offerings Differentiated Regulatory Position ▪ “Unlimited” repair station licenses ▪ Ability to fast track new FAA approved capabilities Long - Term Customer Relationships ▪ Established customer relationships over 30+ years ▪ Key downstream supply / demand perspectives $28 $50 $55 $68 PF2017A PF2018A PF2019F 2020F $212 $272 $310 $336 PF2017A PF2018A PF2019F 2020F

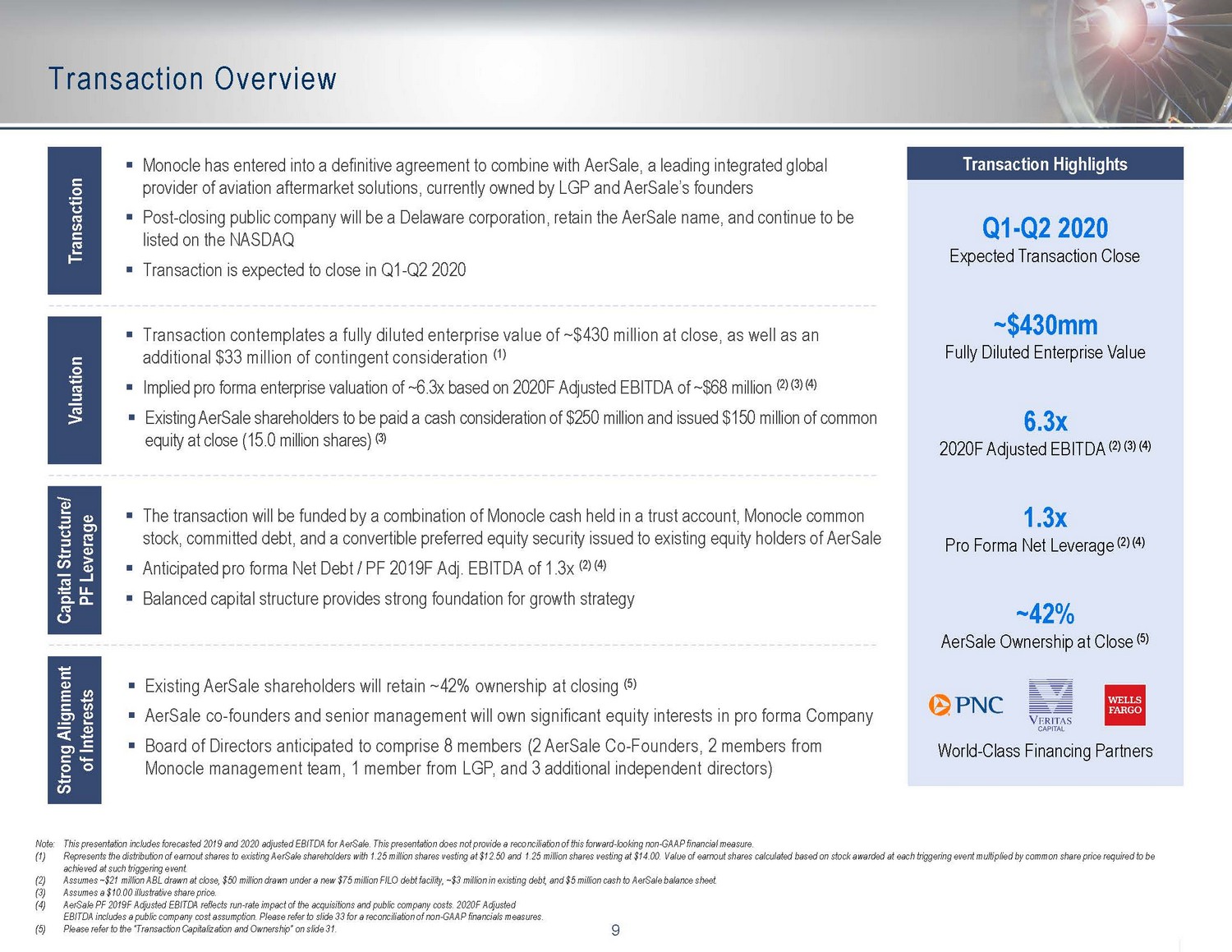

9 Transaction Overview Note: This presentation includes forecasted 2019 and 2020 adjusted EBITDA for AerSale. This presentation does not provide a reco nciliation of this forward - looking non - GAAP financial measure. (1) Represents the distribution of earnout shares to existing AerSale shareholders with 1.25 million shares vesting at $12.50 and 1. 25 million shares vesting at $14.00. Value of earnout shares calculated based on stock awarded at each triggering event multi pli ed by common share price required to be achieved at such triggering event. (2) Assumes ~$21 million ABL drawn at close, $50 million drawn under a new $75 million FILO debt facility, ~$3 million in existin g d ebt, and $5 million cash to AerSale balance sheet. (3) Assumes a $10.00 illustrative share price. (4) AerSale PF 2019F Adjusted EBITDA reflects run - rate impact of the acquisitions and public company costs. 2020F Adjusted EBITDA includes a public company cost assumption. Please refer to slide 33 for a reconciliation of non - GAAP financials measures. (5) Please refer to the “Transaction Capitalization and Ownership” on slide 31. Transaction Valuation Capital Structure/ PF Leverage Strong Alignment of Interests ▪ Monocle has entered into a definitive agreement to combine with AerSale, a leading integrated global provider of aviation aftermarket solutions, currently owned by LGP and AerSale’s founders ▪ Post - closing public company will be a Delaware corporation, retain the AerSale name, and continue to be listed on the NASDAQ ▪ Transaction is expected to close in Q1 - Q2 2020 ▪ Transaction contemplates a fully diluted enterprise value of ~$430 million at close, as well as an additional $33 million of contingent consideration (1) ▪ Implied pro forma enterprise valuation of ~6.3x based on 2020F Adjusted EBITDA of ~$68 million (2) (3) (4) ▪ Existing AerSale shareholders to be paid a cash consideration of $250 million and issued $150 million of common equity at close (15.0 million shares) (3) ▪ The transaction will be funded by a combination of Monocle cash held in a trust account, Monocle common stock, committed debt, and a convertible preferred equity security issued to existing equity holders of AerSale ▪ Anticipated pro forma Net Debt / PF 2019F Adj. EBITDA of 1.3x (2) (4) ▪ Balanced capital structure provides strong foundation for growth strategy ▪ Existing AerSale shareholders will retain ~42% ownership at closing (5) ▪ AerSale co - founders and senior management will own significant equity interests in pro forma Company ▪ Board of Directors anticipated to comprise 8 members (2 AerSale Co - Founders, 2 members from Monocle management team, 1 member from LGP, and 3 additional independent directors) Q1 - Q2 2020 Expected Transaction Close ~$430mm Fully Diluted Enterprise Value 6.3x 2020F Adjusted EBITDA (2) (3) (4) Transaction Highlights 1.3x Pro Forma Net Leverage (2) (4) ~42% AerSale Ownership at Close (5) World - Class Financing Partners

10 7 Business combination at an attractive valuation relative to public commercial aerospace aftermarket peers 4 Multiple levers for sustained organic growth across existing and new business lines 6 Proven leadership team with deep industry expertise across multiple aviation business cycles 2 Differentiated business model designed to maximize a return on investment (“ROI”) across cycles 3 Long - standing relationships across the value chain to support procurement and monetization of assets 5 Scalable platform for growth through M&A, with a demonstrated ability to acquire and integrate businesses 1 Well - positioned in the resilient and rapidly expanding commercial aviation aftermarket AerSale Investment Highlights

Section II Business Overview & Growth Opportunities

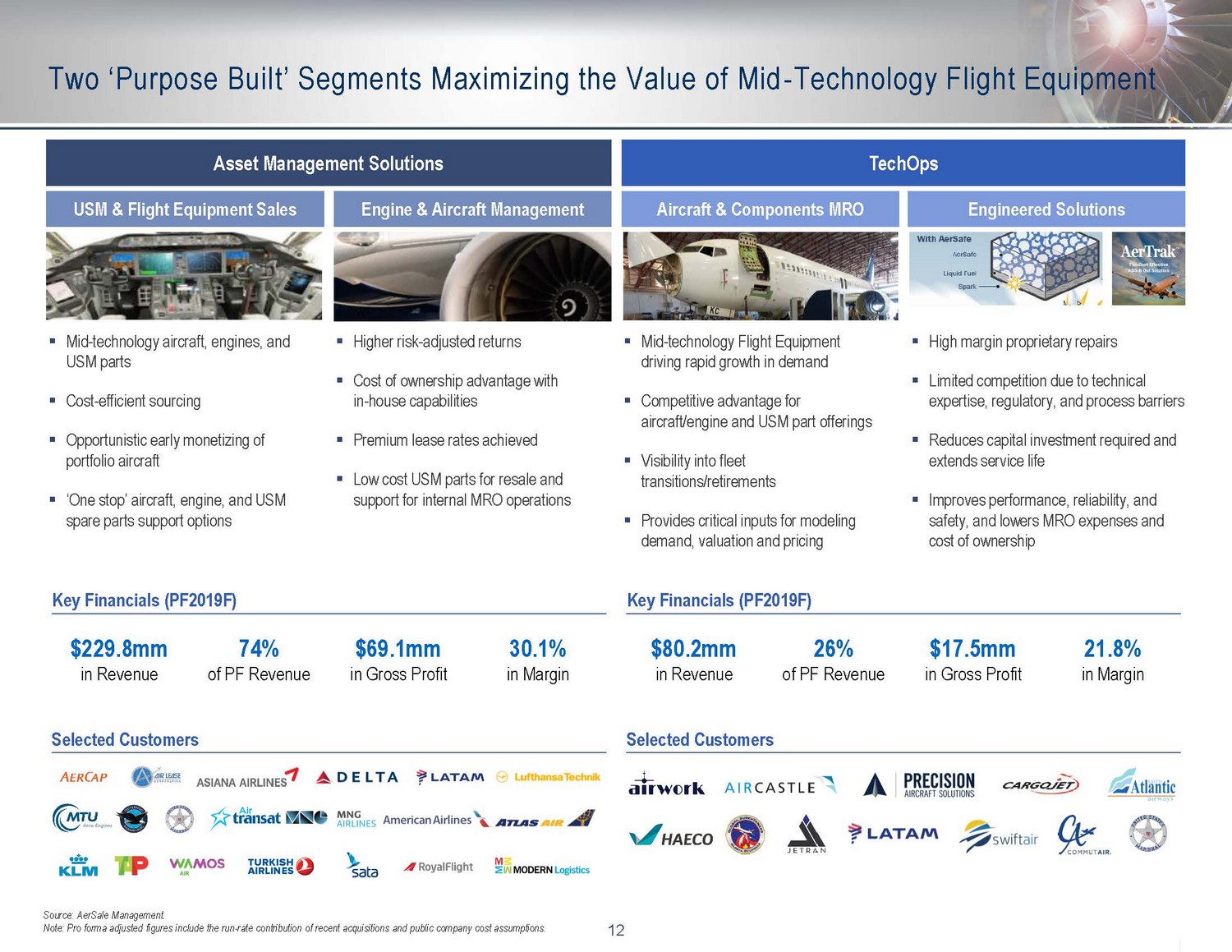

12 Two ‘Purpose Built’ Segments Maximizing the Value of Mid - Technology Flight Equipment ▪ Mid - technology aircraft, engines, and USM parts ▪ Cost - efficient sourcing ▪ Opportunistic early monetizing of portfolio aircraft ▪ ‘One stop’ aircraft, engine, and USM spare parts support options Source: AerSale Management. Note: Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. Asset Management Solutions TechOps USM & Flight Equipment Sales Engine & Aircraft Management Aircraft & Components MRO Engineered Solutions Key Financials (PF2019F) $229.8mm in Revenue $69.1mm in Gross Profit 30.1% in Margin 74% of PF Revenue Key Financials (PF2019F) Selected Customers $80.2mm in Revenue $17.5mm in Gross Profit 21.8% in Margin 26% of PF Revenue ▪ Higher risk - adjusted returns ▪ Cost of ownership advantage with in - house capabilities ▪ Premium lease rates achieved ▪ Low cost USM parts for resale and support for internal MRO operations ▪ Mid - technology Flight Equipment driving rapid growth in demand ▪ Competitive advantage for aircraft/engine and USM part offerings ▪ Visibility into fleet transitions/retirements ▪ Provides critical inputs for modeling demand, valuation and pricing ▪ High margin proprietary repairs ▪ Limited competition due to technical expertise, regulatory, and process barriers ▪ Reduces capital investment required and extends service life ▪ Improves performance, reliability, and safety, and lowers MRO expenses and cost of ownership Selected Customers

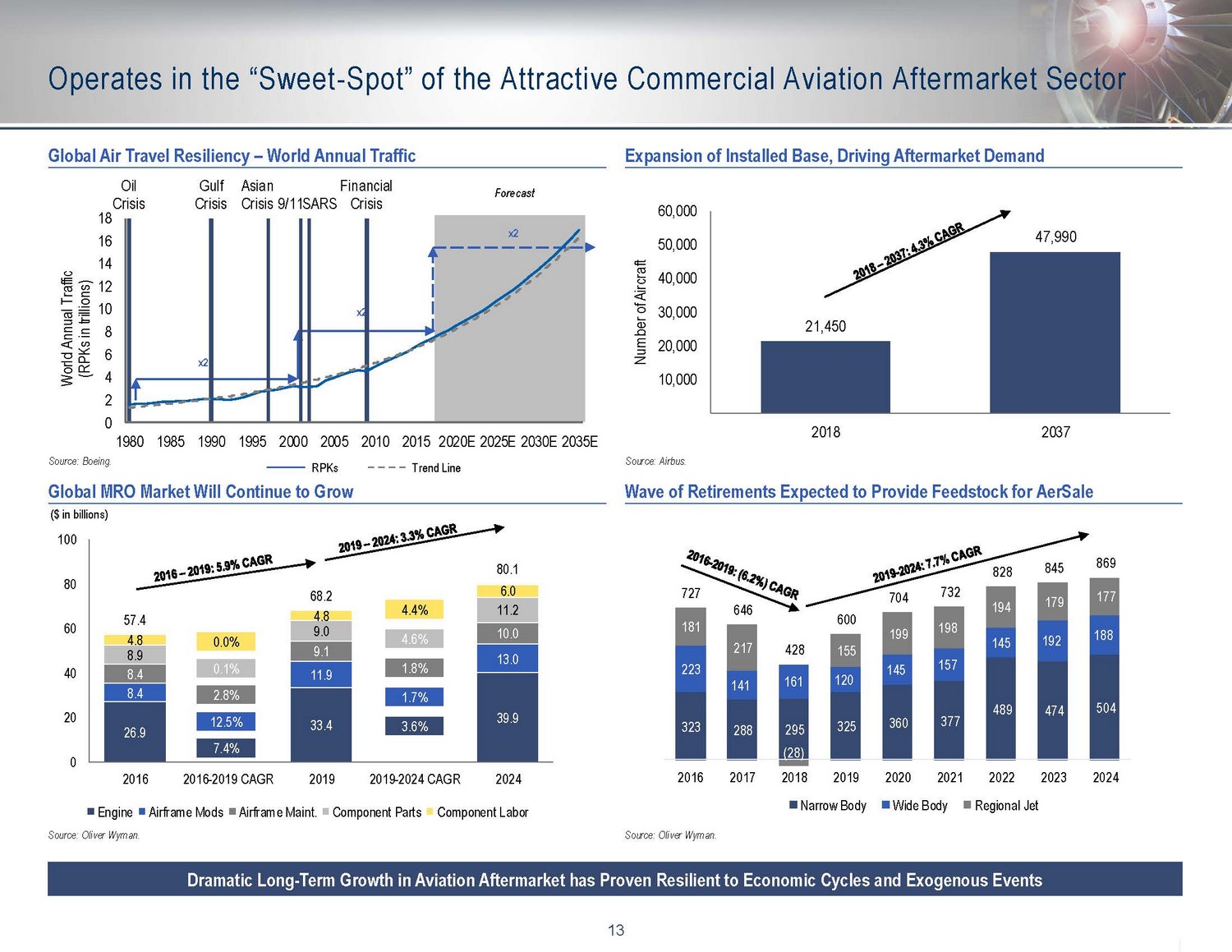

13 323 288 295 325 360 377 489 474 504 223 141 161 120 145 157 145 192 188 181 217 (28) 155 199 198 194 179 177 727 646 428 600 704 732 828 845 869 2016 2017 2018 2019 2020 2021 2022 2023 2024 Narrow Body Wide Body Regional Jet 21,450 47,990 10,000 20,000 30,000 40,000 50,000 60,000 2018 2037 Number of Aircraft Dramatic Long - Term Growth in Aviation Aftermarket has Proven Resilient to Economic Cycles and Exogenous Events Global Air Travel Resiliency – World Annual Traffic Expansion of Installed Base, Driving Aftermarket Demand Global MRO Market Will Continue to Grow Wave of Retirements Expected to Provide Feedstock for AerSale x2 x2 RPKs Trend Line Forecast x2 Oil Crisis Gulf Crisis Asian Crisis 9/11 SARS Financial Crisis 0 2 4 6 8 10 12 14 16 18 1980 1985 1990 1995 2000 2005 2010 2015 2020E 2025E 2030E 2035E World Annual Traffic (RPKs in trillions) Source: Boeing. Source: Airbus. 26.9 33.4 39.9 8.4 11.9 13.0 8.4 9.1 10.0 8.9 9.0 11.2 4.8 4.8 6.0 57.4 68.2 80.1 0 20 40 60 80 100 2016 2016-2019 CAGR 2019 2019-2024 CAGR 2024 Engine Airframe Mods Airframe Maint. Component Parts Component Labor 4.6% 3.6% 1.7% 1.8% 4.4% Source: Oliver Wyman. Source: Oliver Wyman. ($ in billions) 0.1% 7.4% 12.5% 2.8% 0.0% Operates in the “Sweet - Spot” of the Attractive Commercial Aviation Aftermarket Sector

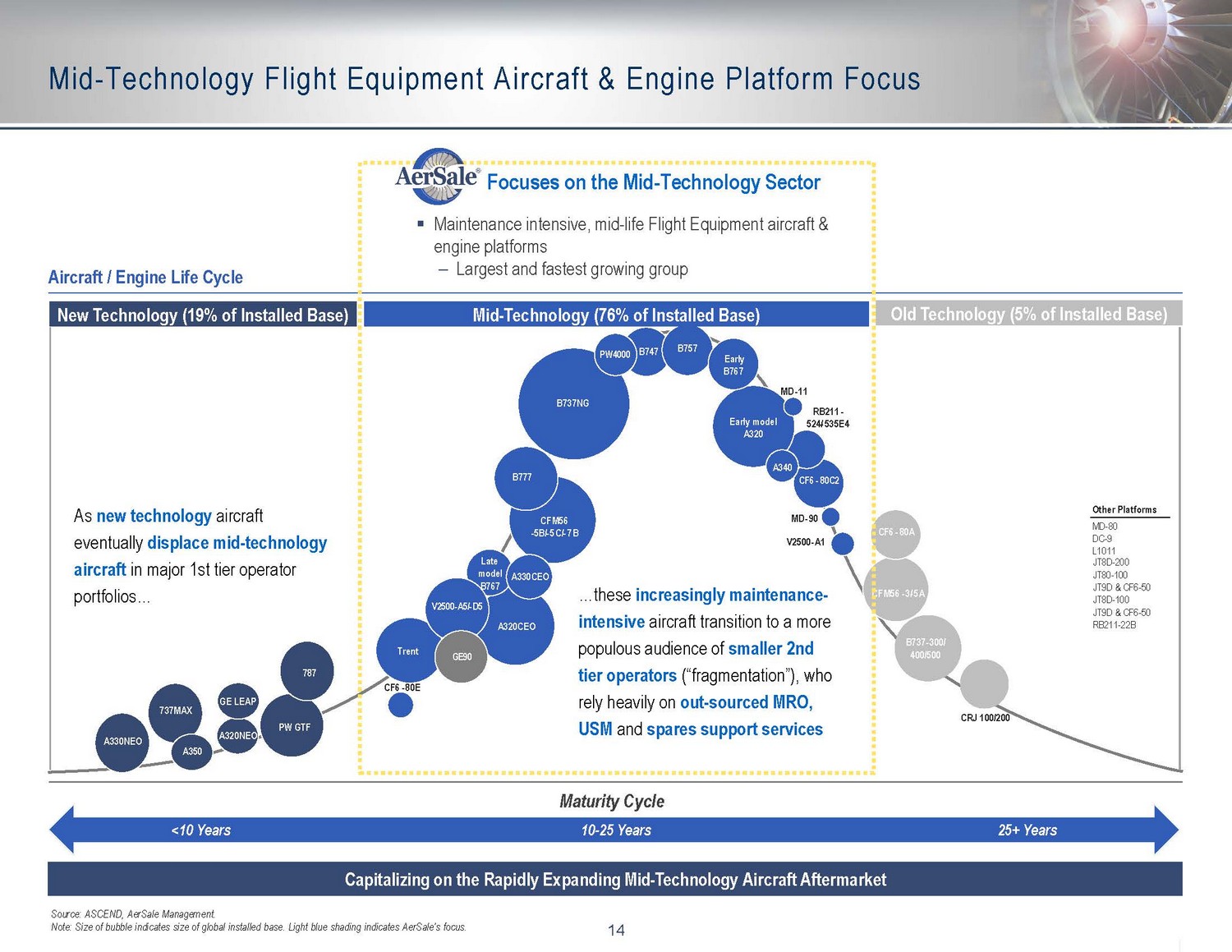

14 B737NG Mid - Technology Flight Equipment Aircraft & Engine Platform Focus Ear l y mode l A 320 A330CEO M D - 9 0 CRJ 100/2 0 0 M D - 1 1 T rent B757 C F 6 - 80 C 2 V250 0 - A 1 CFM 5 6 - 3 / - 5 A B73 7 - 300/ 400/5 00 A 340 A330NEO PW 4000 A320CEO CFM 5 6 - 5 B / - 5 C / - 7 B V 250 0 - A 5 / - D 5 C F 6 - 80E B777 Late m odel B767 MD - 80 DC - 9 L1011 JT8D - 200 JT80 - 100 JT9D & CF6 - 50 JT8D - 100 JT9D & CF6 - 50 RB211 - 22B New Technology (19% of Installed Base) Mid - Technology (76% of Installed Base) Old Technology (5% of Installed Base) RB2 1 1 - 524 / - 5 35E4 Source: ASCEND, AerSale Management. Note: Size of bubble indicates size of global installed base. Light blue shading indicates AerSale’s focus. Aircraft / Engine Life Cycle 737MAX A350 A320NEO GE LEAP PW GTF 787 Ear l y B767 C F 6 - 80 A B747 Focuses on the Mid - Technology Sector GE90 Other Platforms As new technology aircraft eventually displace mid - technology aircraft in major 1st tier operator portfolios… …these increasingly maintenance - intensive aircraft transition to a more populous audience of smaller 2nd tier operators (“fragmentation”), who rely heavily on out - sourced MRO, USM and spares support services ▪ Maintenance intensive, mid - life Flight Equipment aircraft & engine platforms Largest and fastest growing group Maturity Cycle 10 - 25 Years 25+ Years <10 Years Capitalizing on the Rapidly Expanding Mid - Technology Aircraft Aftermarket

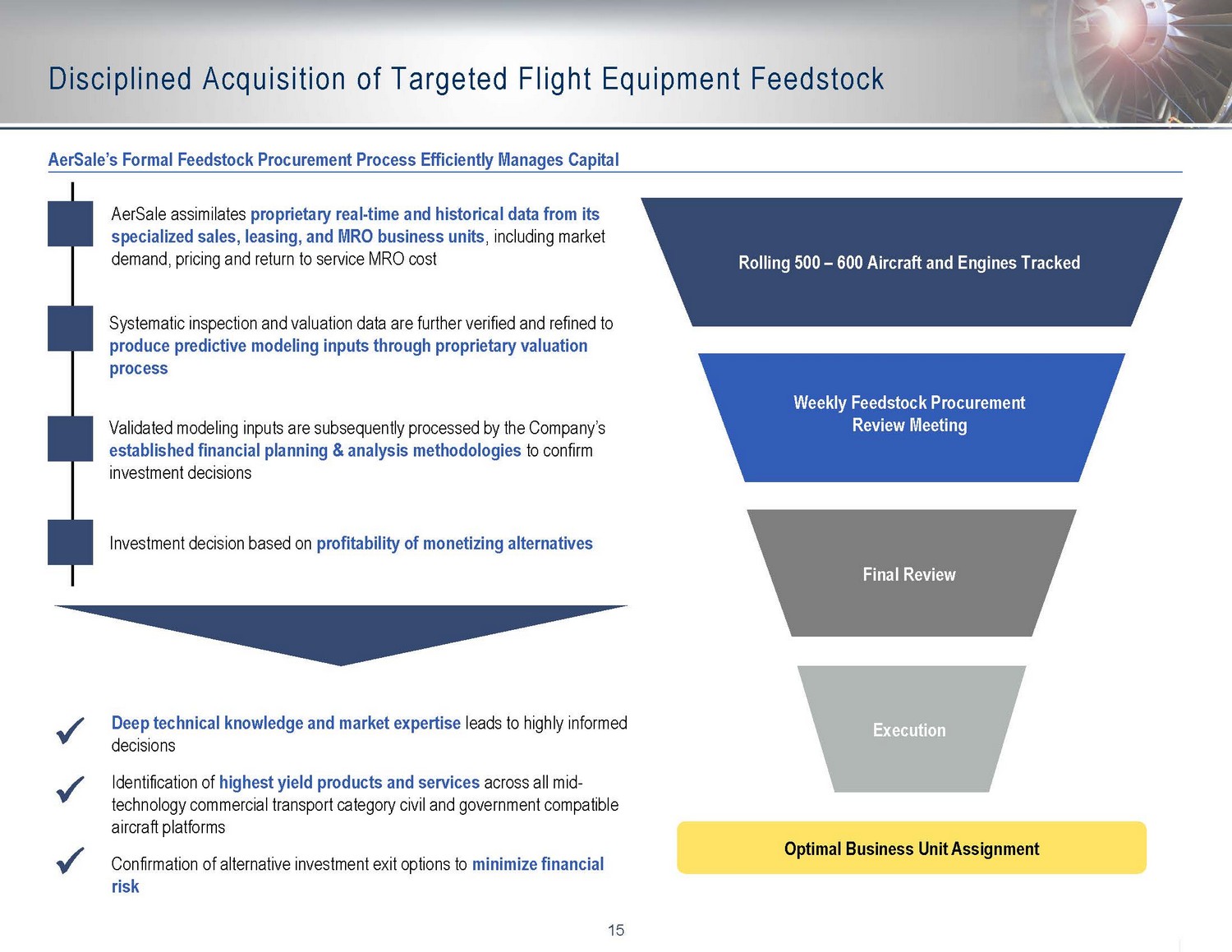

15 Disciplined Acquisition of Targeted Flight Equipment Feedstock AerSale’s Formal Feedstock Procurement Process Efficiently Manages Capital Optimal Business Unit Assignment Rolling 500 – 600 Aircraft and Engines Tracked Weekly Feedstock Procurement Review Meeting Final Review Execution AerSale assimilates proprietary real - time and historical data from its specialized sales, leasing, and MRO business units , including market demand, pricing and return to service MRO cost Validated modeling inputs are subsequently processed by the Company’s established financial planning & analysis methodologies to confirm investment decisions Systematic inspection and valuation data are further verified and refined to produce predictive modeling inputs through proprietary valuation process Investment decision based on profitability of monetizing alternatives Deep technical knowledge and market expertise leads to highly informed decisions x Identification of highest yield products and services across all mid - technology commercial transport category civil and government compatible aircraft platforms x Confirmation of alternative investment exit options to minimize financial risk x

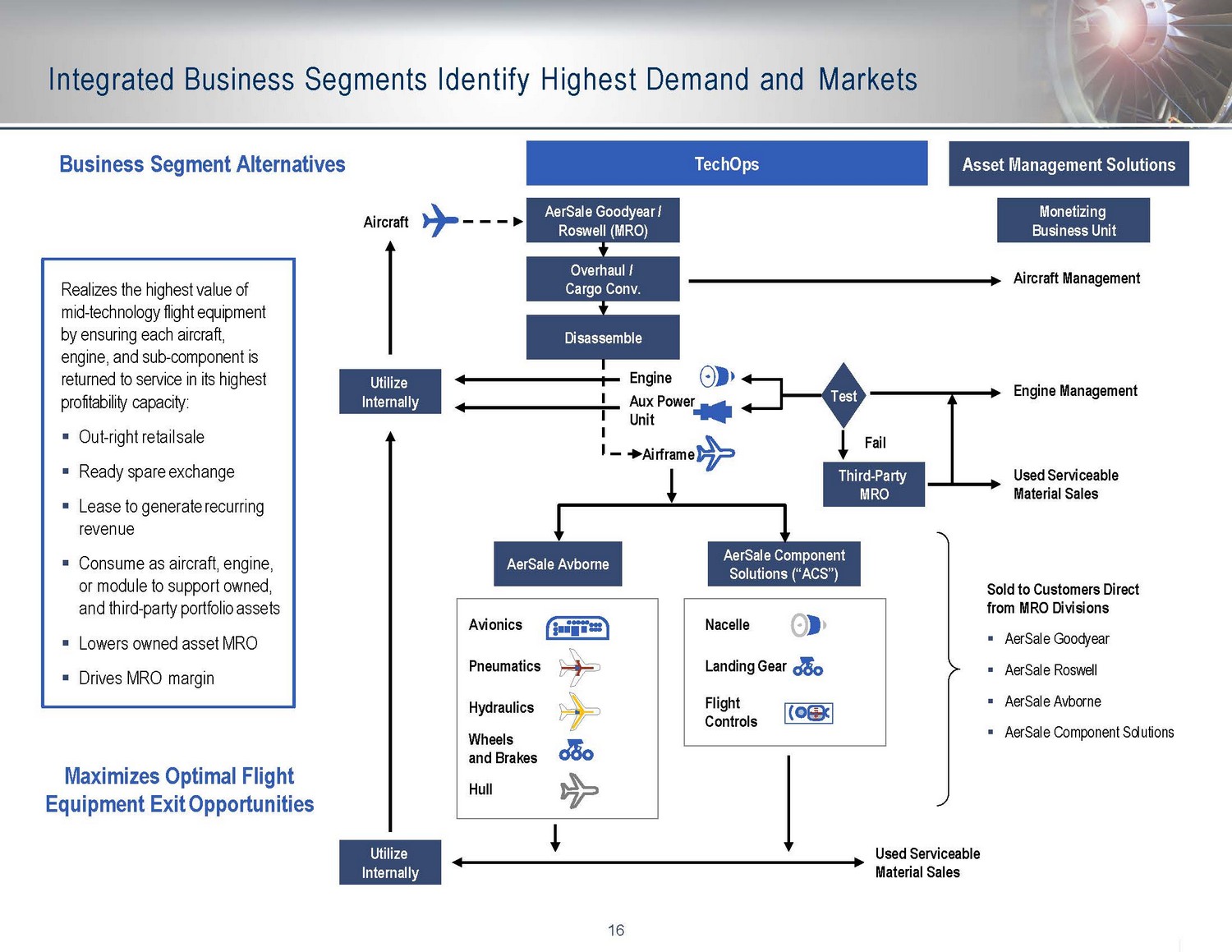

16 Integrated Business Segments Identify Highest Demand and Markets Business Segment Alternatives Realizes the highest value of mid - technology flight equipment by ensuring each aircraft, engine, and sub - component is returned to service in it s highest profitability capacity: ▪ Out - right retail sale ▪ Ready spare exchange ▪ Lease to generate recurring revenue ▪ Consume as aircraft, engine, or module to support owned, and third - party portfolio assets ▪ Lowers owned asset MRO ▪ Drives MRO margin Maximizes Optimal Flight Equipment Exit Opportunities Aircraft Airframe Utilize Internally Utilize Internally AerSale Avborne AerSale Component Solutions (“ACS”) Third - Party MRO AerSale Goodyear / Roswell (MRO) Overhaul / Cargo Conv. Disassemble Engine Aux Power Unit Avionics Pneumatics Hydraulics Wheels and Brakes Hull Nacelle Landing Gear Flight Controls Aircraft Management Engine Management Used Serviceable Material Sales Test Fail Sold to Customers Direct from MRO Divisions ▪ AerSale Goodyear ▪ AerSale Roswell ▪ AerSale Avborne ▪ AerSale Component Solutions Monetizing Business Unit Used Serviceable Material Sales TechOps Asset Management Solutions

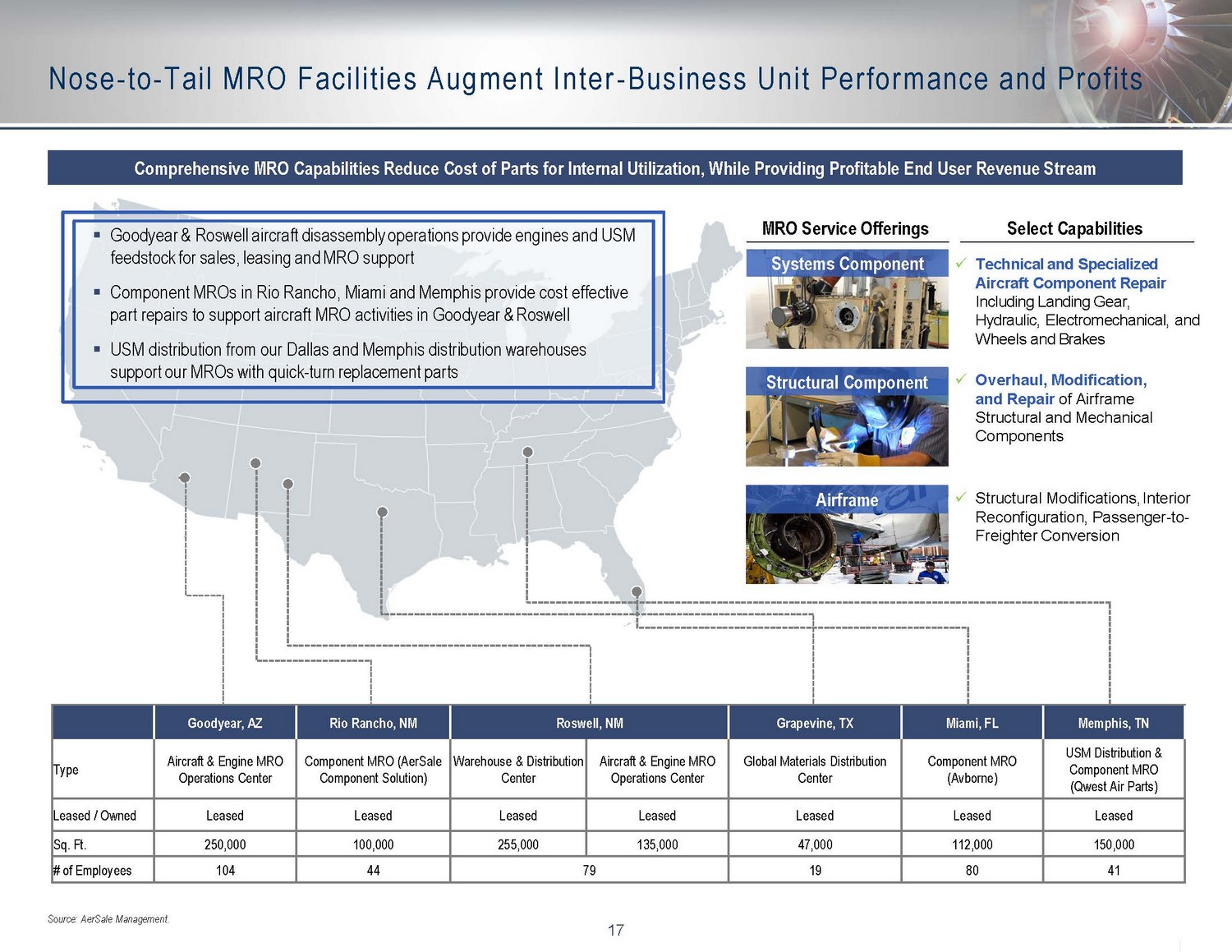

17 Nose - to - Tail MRO Facilities Augment Inter - Business Unit Performance and Profits Select Capabilities Comprehensive MRO Capabilities Reduce Cost of Parts for Internal Utilization, While Providing Profitable End User Revenue Str eam MRO Service Offerings Source: AerSale Management. Goodyear, AZ Rio Rancho, NM Roswell, NM Grapevine, TX Miami, FL Memphis, TN Type Aircraft & Engine MRO Operations Center Component MRO (AerSale Component Solution) Warehouse & Distribution Center Aircraft & Engine MRO Operations Center Global Materials Distribution Center Component MRO (Avborne) USM Distribution & Component MRO (Qwest Air Parts) Leased / Owned Leased Leased Leased Leased Leased Leased Leased Sq. Ft. 250,000 100,000 255,000 135,000 47,000 112,000 150,000 # of Employees 104 44 79 19 80 41 Systems Component Structural Component Airframe ▪ Goodyear & Roswell aircraft disassembly operations provide engines and USM feedstock for sales, leasing and MRO support ▪ Component MROs in Rio Rancho, Miami and Memphis provide cost effective part repairs to support aircraft MRO activities in Goodyear & Roswell ▪ USM distribution from our Dallas and Memphis distribution warehouses support our MROs with quick - turn replacement parts x Overhaul, Modification, and Repair of Airframe Structural and Mechanical Components x Structural Modifications, Interior Reconfiguration, Passenger - to - Freighter Conversion x Technical and Specialized Aircraft Component Repair Including Landing Gear, Hydraulic, Electromechanical, and Wheels and Brakes

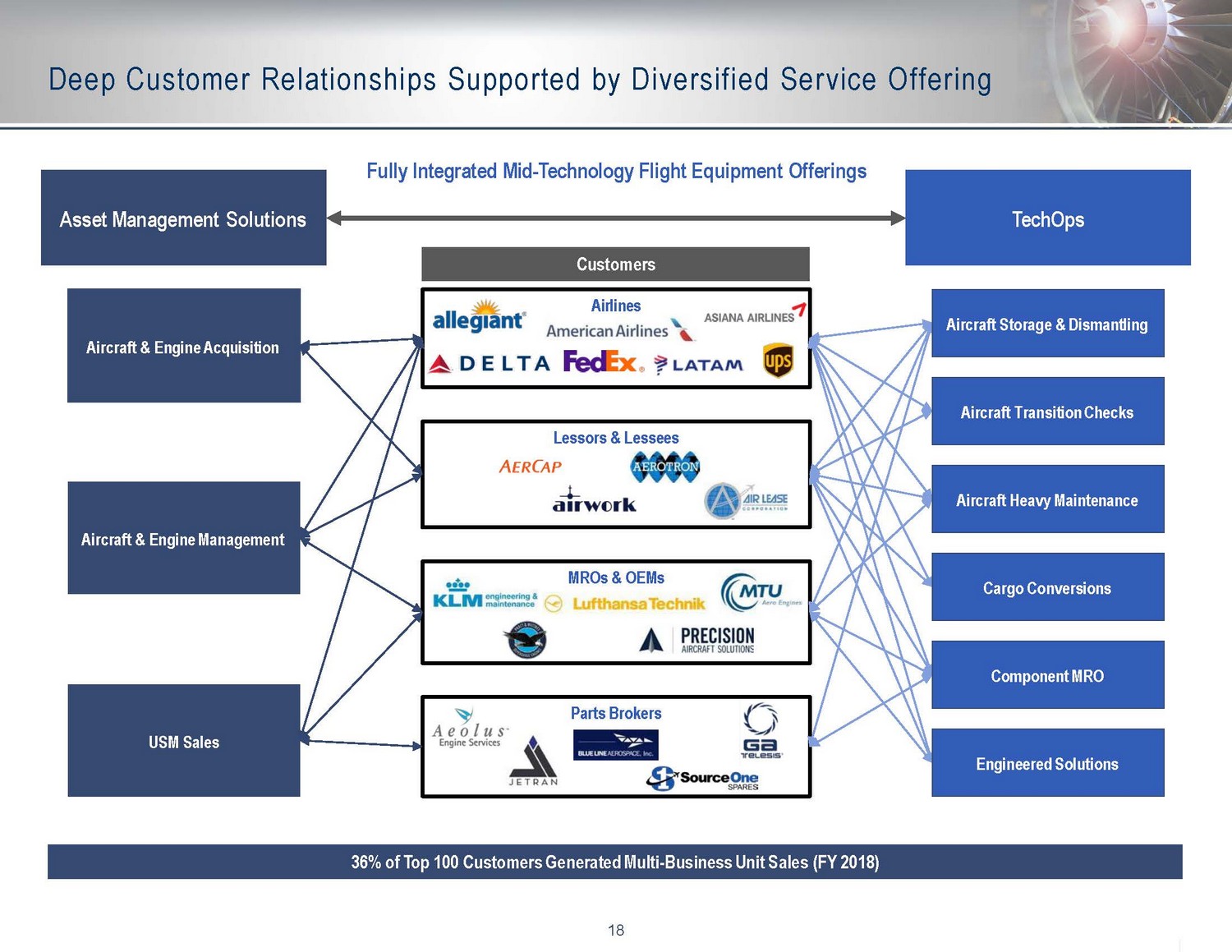

18 Deep Customer Relationships Supported by Diversified Service Offering 36% of Top 100 Customers Generated Multi - Business Unit Sales (FY 2018) Asset Management Solutions Aircraft & Engine Acquisition Aircraft & Engine Management USM Sales Customers Airlines MROs & OEMs Lessors & Lessees Parts Brokers TechOps Aircraft Heavy Maintenance Aircraft Storage & Dismantling Component MRO Cargo Conversions Aircraft Transition Checks Engineered Solutions Fully Integrated Mid - Technology Flight Equipment Offerings

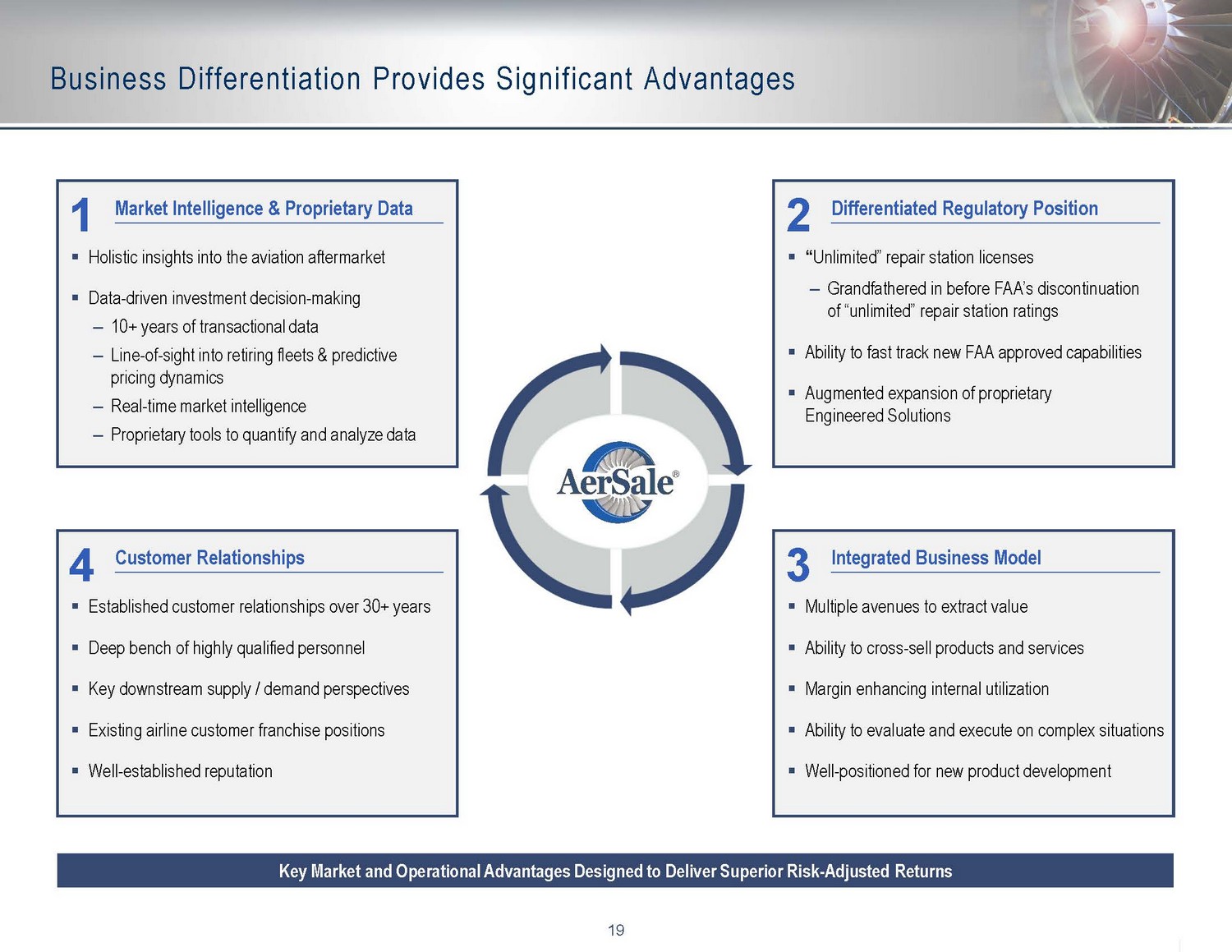

19 Business Differentiation Provides Significant Advantages Market Intelligence & Proprietary Data ▪ Holistic insights into the aviation afterma rket ▪ Data - driven investment decision - making – 10+ years of transactional data – L ine - of - sight into retiring fleets & predictive pricing dynamics – Real - time market intelligence – Proprietary tools to quantify and analyze data 1 Differentiated Regulatory Position ▪ “ Unlimited” repair station licenses – Grandfathered in before FAA’s discontinuation of “unlimited” repair station ratings ▪ Ability to fast track new FAA approved capabilities ▪ Augmented expansion of proprietary Engineered Solutions 2 Integrated Business Model ▪ Multiple avenues to extract value ▪ Ability to cross - sell products and services ▪ Margin enhancing internal utilization ▪ Ability to evaluate and execute on complex situations ▪ Well - positioned for new product development 3 Customer Relationships ▪ Established customer relationships over 30+ years ▪ Deep bench of highly qualified personnel ▪ Key downstream supply / demand perspectives ▪ Existing airline customer franchise positions ▪ Well - established reputation 4 Key Market and Operational Advantages Designed to Deliver Superior Risk - Adjusted Returns

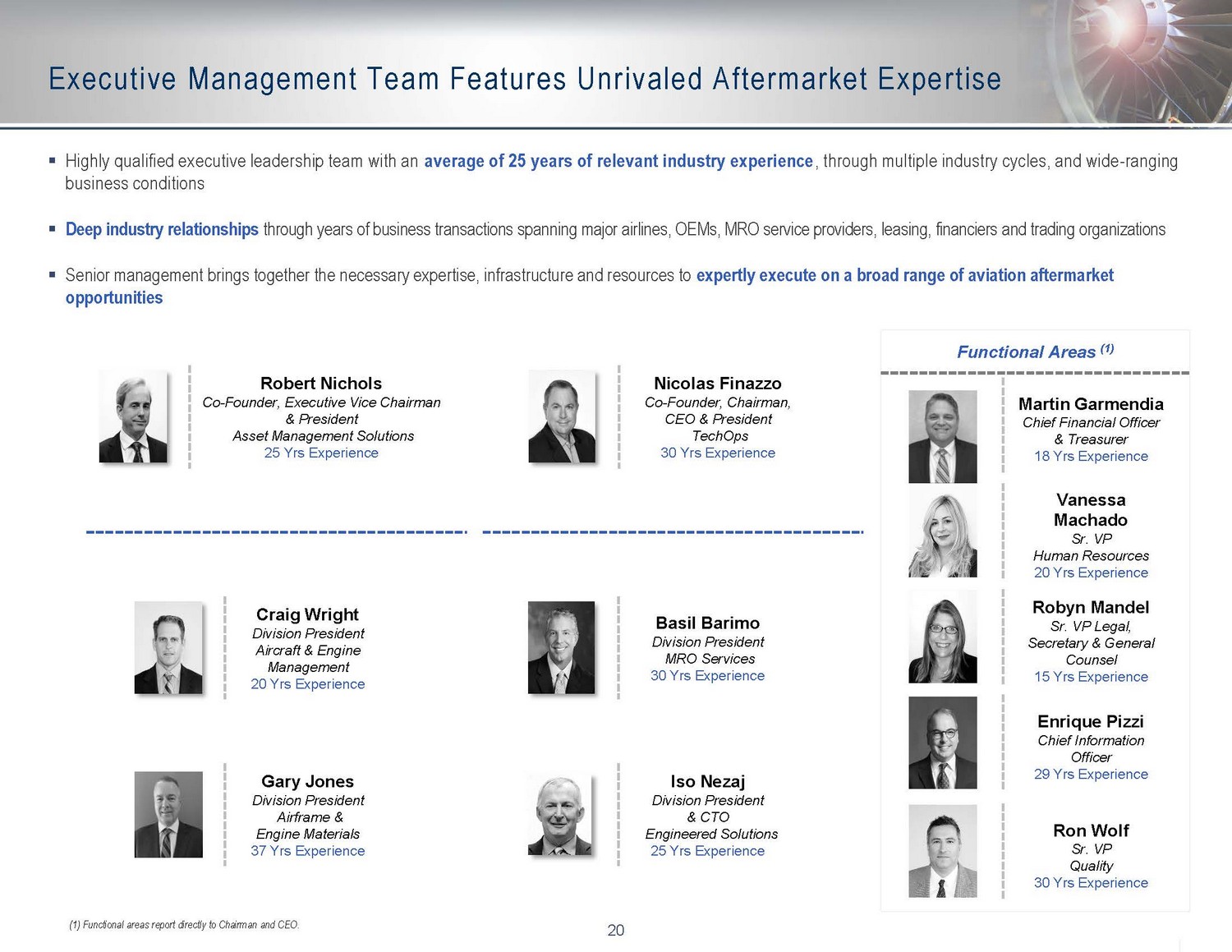

20 Executive Management Team Features Unrivaled Aftermarket Expertise ▪ Highly qualified executive leadership team with an average of 25 years of relevant industry experience , through multiple industry cycles, and wide - ranging business conditions ▪ Deep industry relationships through years of business transactions spanning major airlines, OEMs, MRO service providers, leasing, financiers and trading org anizations ▪ S enior management brings together the necessary expertise, infrastructure and resources to expertly execute on a broad range of aviation aftermarket opportunities 20 Martin Garmendia Chief Financial Officer & Treasurer 18 Yrs Experience Vanessa Machado Sr. VP Human Resources 20 Yrs Experience Functional Areas (1) Robert Nichols Co - Founder, Executive Vice Chairman & President Asset Management Solutions 25 Yrs Experience Craig Wright Division President Aircraft & Engine Management 20 Yrs Experience Nicolas Finazzo Co - Founder, Chairman, CEO & President TechOps 30 Yrs Experience Basil Barimo Division President MRO Services 30 Yrs Experience Iso Nezaj Division President & CTO Engineered Solutions 25 Yrs Experience Ron Wolf Sr. VP Quality 30 Yrs Experience (1) Functional areas report directly to Chairman and CEO. Gary Jones Division President Airframe & Engine Materials 37 Yrs Experience Robyn Mandel Sr. VP Legal, Secretary & General Counsel 15 Yrs Experience Enrique Pizzi Chief Information Officer 29 Yrs Experience

21 Scalable Platform With Proven and Accretive M&A Strategy • Well - positioned for future acquisitions within highly fragmented aviation aftermarket industry • Focus on expanding core capabilities & solutions, expansion into adjacent categories, and penetrating new customers & markets • Long track record of successful integration Geographic Expansion w/ LATAM Market Penetration Emphasis • Strong growth in Latin American low - cost carrier operations driving attractive aftermarket opportunities to support aging fleets • Investing resources in Miami headquarters and Avborne component MRO operations to enhance Latin American coverage Development & Innovation of New Engineered Solutions Offerings • Rapidly increasing demand for significant savings on alternative products and services needed to enhance aircraft performance • High - margin proprietary repairs, modifications, and aircraft system installations that are difficult to replicate Attractive Global Opportunities For Scalable Business Platform Expanded Sales to U.S. Government Agencies • Stable and increasing DoD O&M budget — ~5% CAGR from FY2016 to FY2020 • Defense sector in early stage of outsourced solutions for aging aircraft platforms • AerSale has successfully executed on numerous governmental agency awards Development of New High - Margin MRO Capabilities • Global MRO market will continue to grow — >3% CAGR expected through 2024 • Peak demand for landing gear MRO capacity • Facilities and expertise in place to profitably expand AerSale’s MRO capabilities Growing Aviation Aftermarket With Positive Long - Term Tailwinds • Long - term growth in aviation aftermarket has proven resilient to economic cycles and exogenous events • Significant wave of aircraft retirements expected to increase supply of feedstock 2 1 3 4 5 6 Source: Oliver Wyman 2018 - 2028 Global Fleet MRO Market Forecast, Department of Defense Office of the Comptroller , AerSale Management.

Section III Financial Detail & Transaction Summary

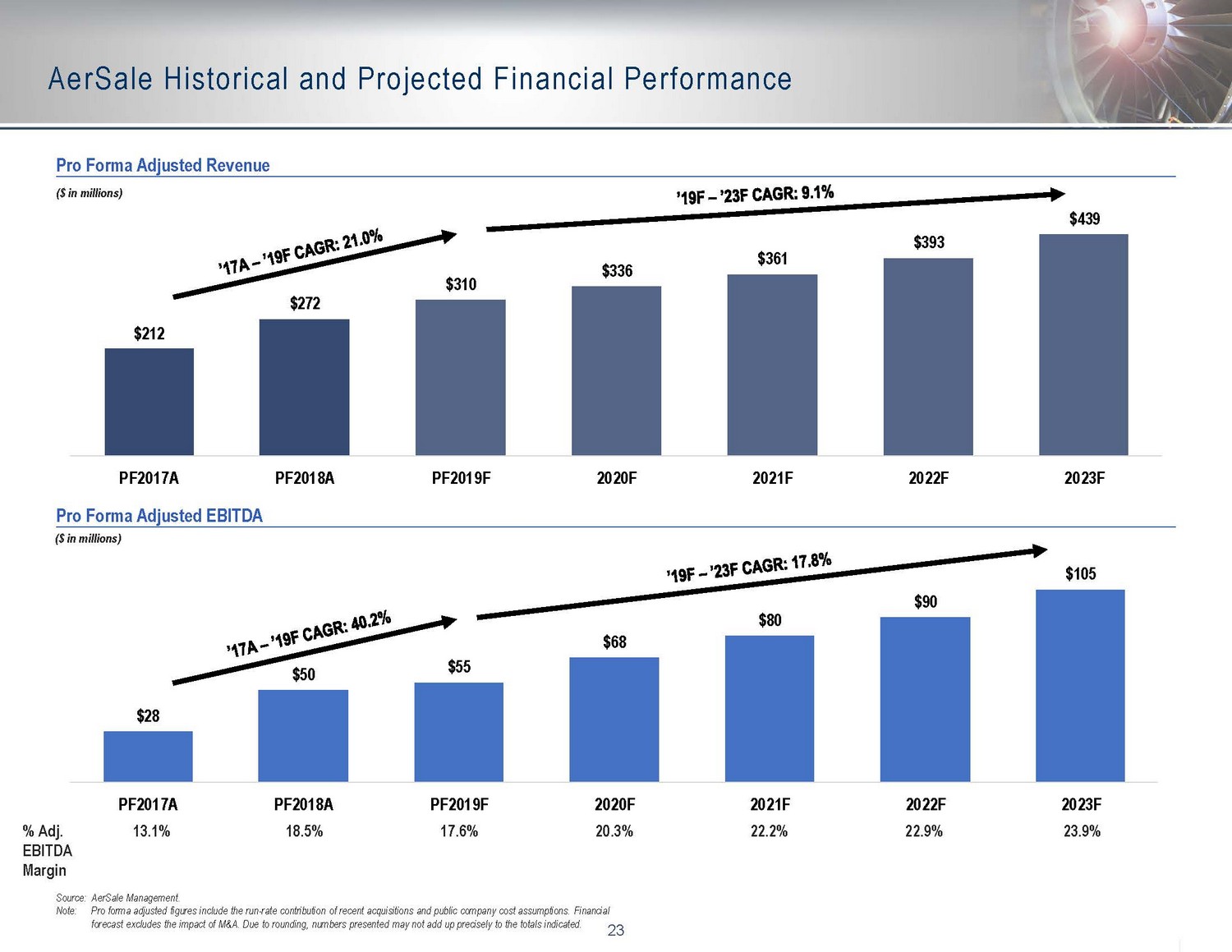

23 AerSale Historical and Projected Financial Performance Source: AerSale Management. Note: Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. Financial forecast excludes the impact of M&A. Due to rounding, numbers presented may not add up precisely to the totals indicated. Pro Forma Adjusted Revenue ($ in millions) Pro Forma Adjusted EBITDA % Adj. EBITDA Margin 13.1% 18.5% 17.6% 20.3% 22.2% 22.9% 23.9% ($ in millions) $212 $272 $310 $336 $361 $393 $439 PF2017A PF2018A PF2019F 2020F 2021F 2022F 2023F $28 $50 $55 $68 $80 $90 $105 PF2017A PF2018A PF2019F 2020F 2021F 2022F 2023F

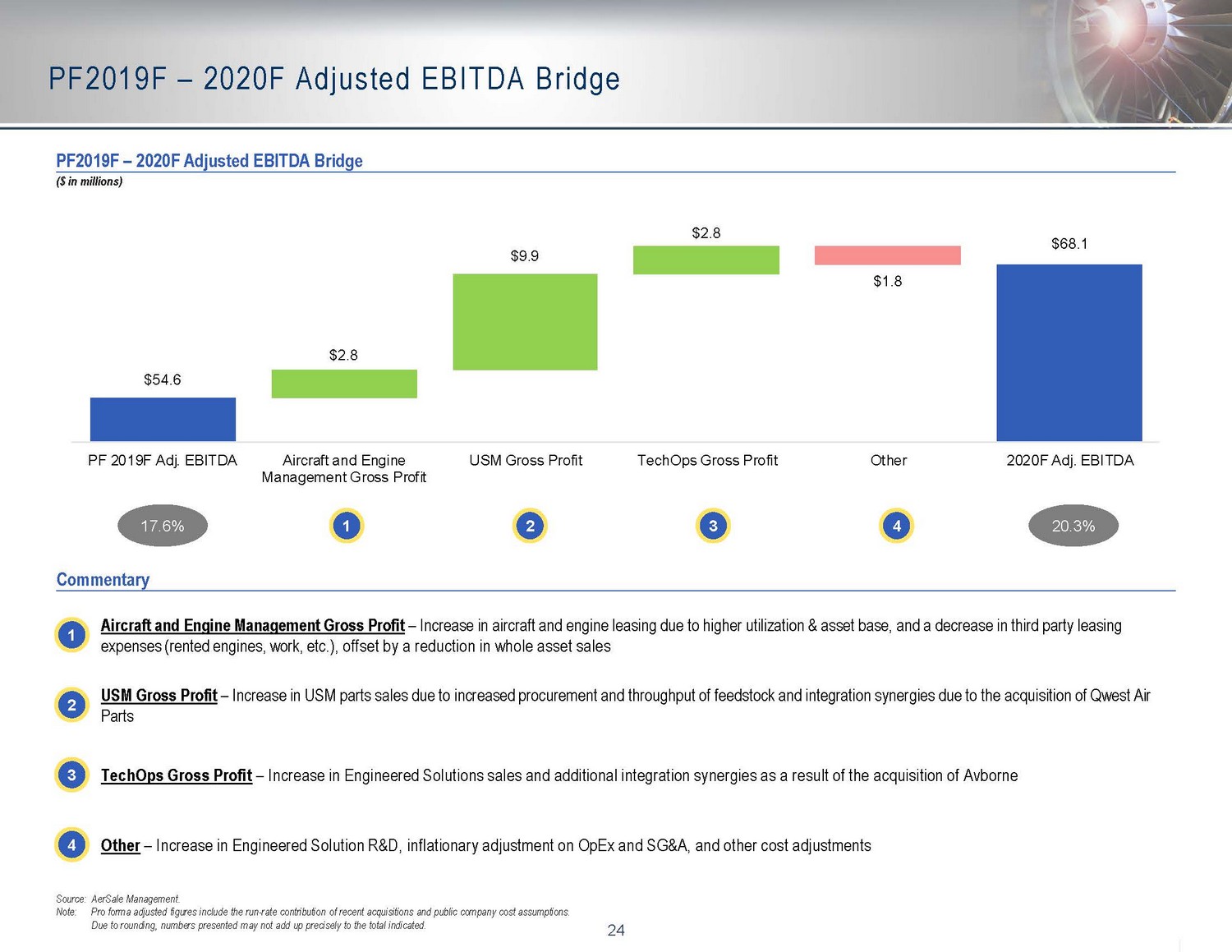

24 PF2019F – 2020F Adjusted EBITDA Bridge Source: AerSale Management. Note: Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. Due to rounding, numbers presented may not add up precisely to the total indicated. PF2019F – 2020F Adjusted EBITDA Bridge $54.6 $68.1 $2.8 $9.9 $2.8 $1.8 PF 2019F Adj. EBITDA Aircraft and Engine Management Gross Profit USM Gross Profit TechOps Gross Profit Other 2020F Adj. EBITDA Commentary 1 2 3 4 17.6% 20.3% 1 Aircraft and Engine Management Gross Profit – Increase in aircraft and engine leasing due to higher utilization & asset base, and a decrease in third party leasing expenses (rented engines, work, etc.) , offset by a reduction in whole asset sales 2 USM Gross Profit – Increase in USM parts sales due to increased procurement and throughput of feedstock and integration synergies due to the acq uisition of Qwest Air Parts 3 TechOps Gross Profit – Increase in Engineered Solutions sales and additional integration synergies as a result of the acquisition of Avborne 4 Other – Increase in Engineered Solution R&D, inflationary adjustment on OpEx and SG&A, and other cost adjustments ($ in millions)

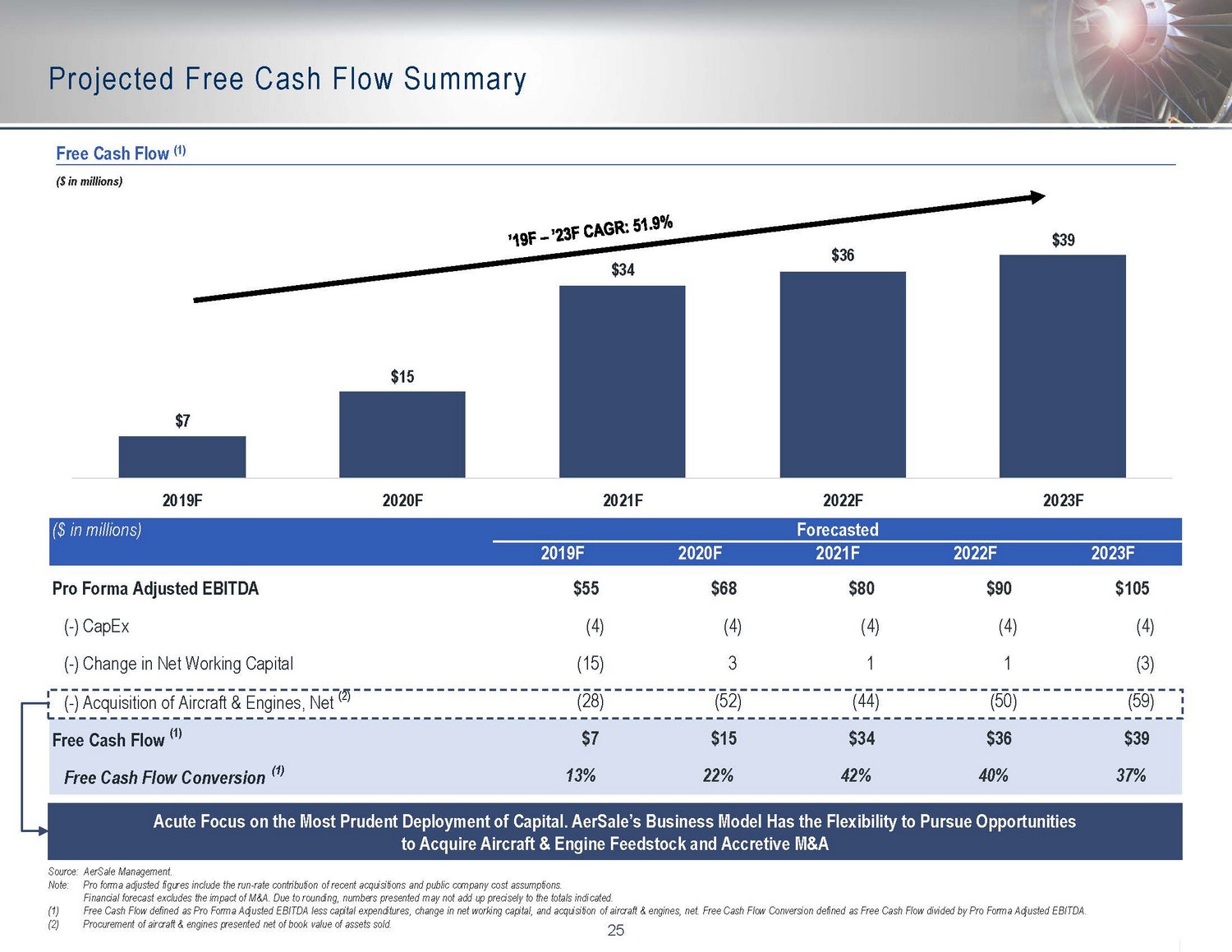

25 ($ in millions) Forecasted 2019F 2020F 2021F 2022F 2023F Pro Forma Adjusted EBITDA $55 $68 $80 $90 $105 (-) CapEx (4) (4) (4) (4) (4) (-) Change in Net Working Capital (15) 3 1 1 (3) (-) Acquisition of Aircraft & Engines, Net (2) (28) (52) (44) (50) (59) Free Cash Flow (1) $7 $15 $34 $36 $39 Free Cash Flow Conversion (1) 13% 22% 42% 40% 37% Projected Free Cash Flow Summary Source: AerSale Management. Note: Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. Financial forecast excludes the impact of M&A. Due to rounding, numbers presented may not add up precisely to the totals indi ca ted. (1) Free Cash Flow defined as Pro Forma Adjusted EBITDA less capital expenditures, change in net working capital, and acquisition of aircraft & engines, net. Free Cash Flow Conversion defined as Free Cash Flow divided by Pro Forma Adjusted EBITDA. (2) Procurement of aircraft & engines presented net of book value of assets sold. Free Cash Flow (1) ($ in millions) Acute Focus on the Most Prudent Deployment of Capital. AerSale’s Business Model Has the Flexibility to Pursue Opportunities to Acquire Aircraft & Engine Feedstock and Accretive M&A $7 $15 $34 $36 $39 2019F 2020F 2021F 2022F 2023F

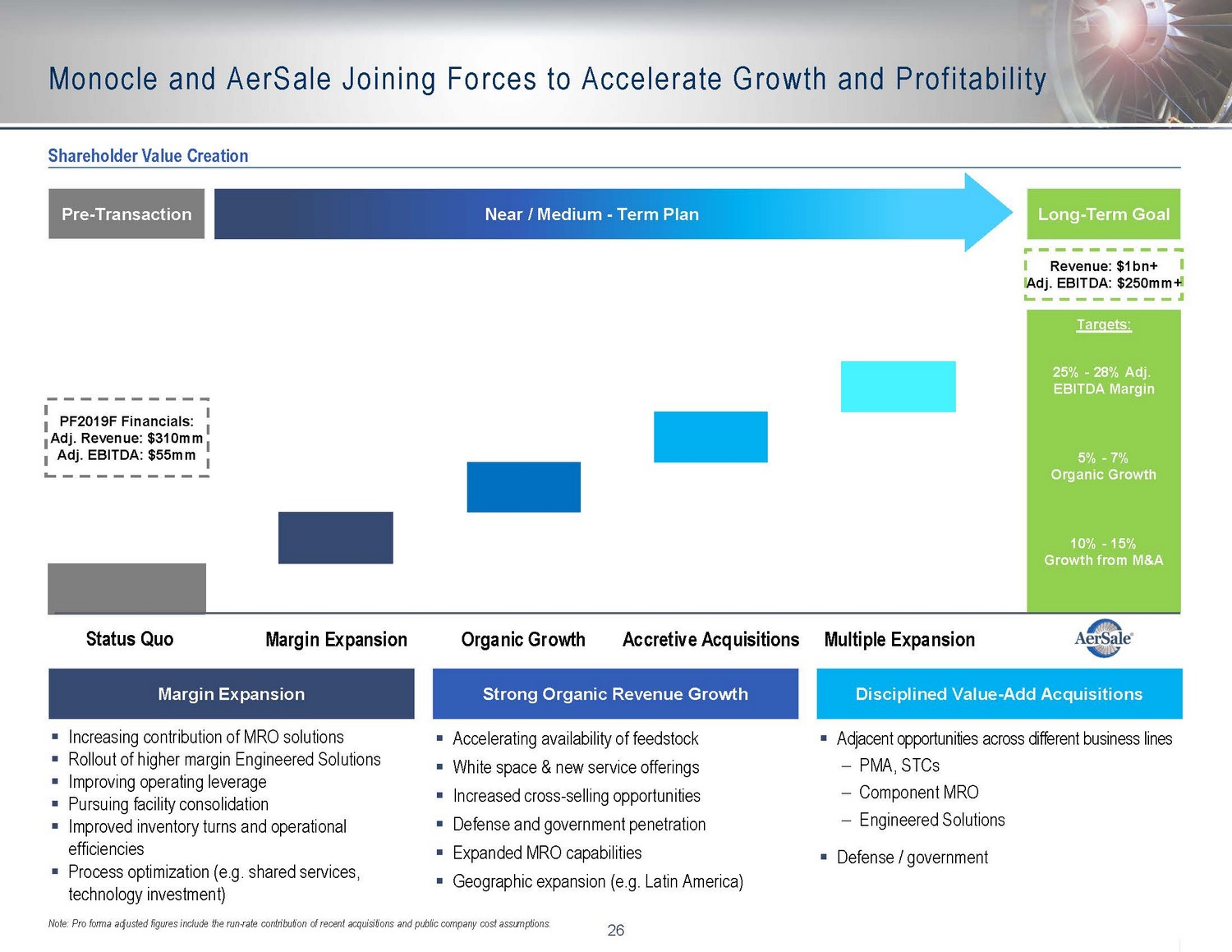

26 Current Status Margin Expansion Organic Growth Accretive Acquisitions Multiple Expansion Shareholder Value Creation Monocle and AerSale Joining Forces to Accelerate Growth and Profitability Margin Expansion Strong Organic Revenue Growth Disciplined Value - Add Acquisitions ▪ Increasing contribution of MRO solutions ▪ Rollout of higher margin Engineered Solutions ▪ Improving operating leverage ▪ Pursuing facility consolidation ▪ Improved inventory turns and operational efficiencies ▪ Process optimization (e.g. shared services, technology investment) ▪ Accelerating availability of feedstock ▪ White space & new service offerings ▪ Increased cross - selling opportunities ▪ Defense and government penetration ▪ Expanded MRO capabilities ▪ Geographic expansion (e.g. Latin America) ▪ Adjacent opportunities across different business lines PMA, STCs Component MRO Engineered Solutions ▪ Defense / government Pre - Transaction Near / Medium - Term Plan Long - Term Goal PF2019F Financials: Adj. Revenue: $310mm Adj. EBITDA: $55mm Revenue: $1bn+ Adj. EBITDA: $250mm+ Note: Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. Targets: 25% - 28% Adj. EBITDA Margin 5% - 7% Organic Growth 10% - 15% Growth from M&A Status Quo

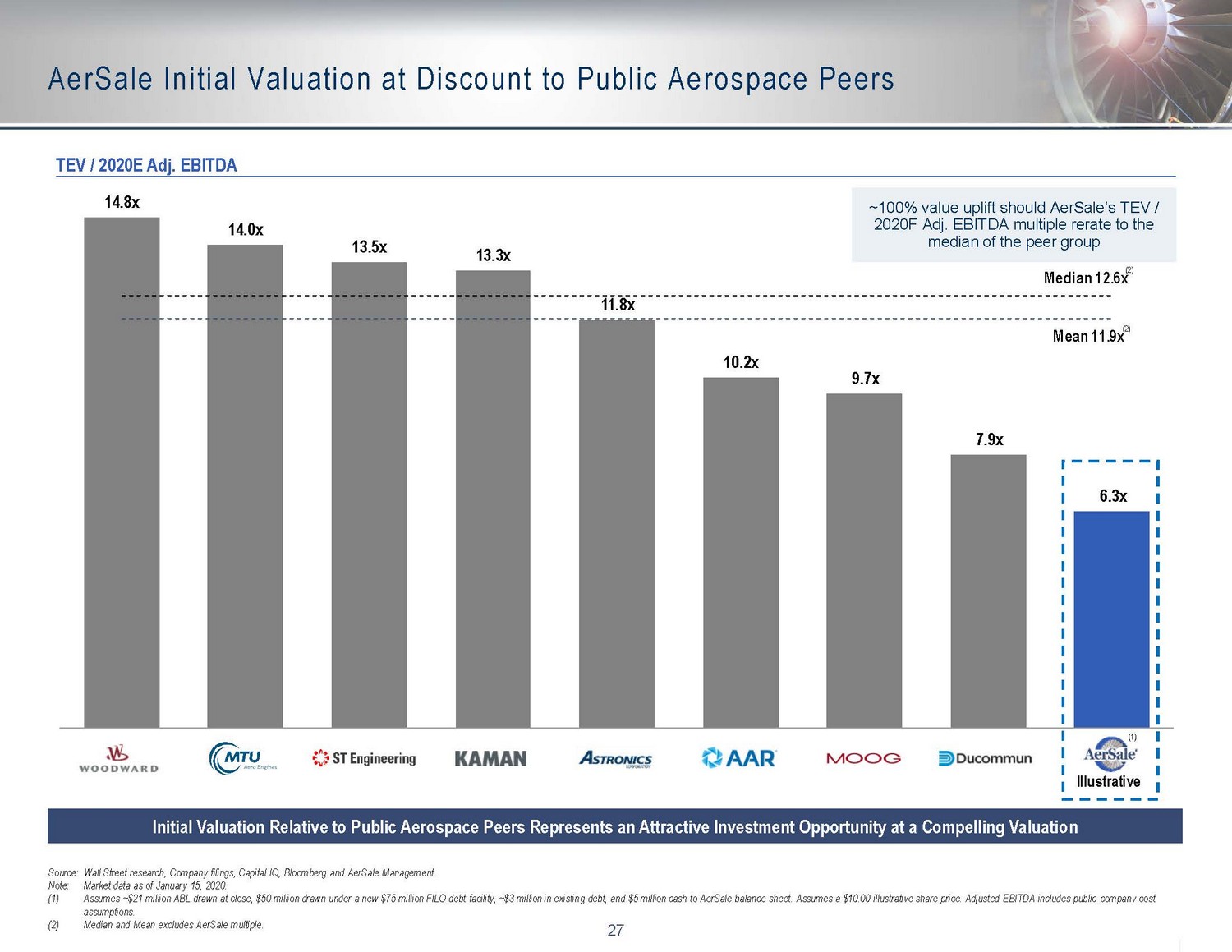

27 14.8x 14.0x 13.5x 13.3x 11.8x 10.2x 9.7x 7.9x 6.3x Median 12.6x Mean 11.9x AerSale Initial Valuation at Discount to Public Aerospace Peers 27 Source: Wall Street research, Company filings, Capital IQ, Bloomberg and AerSale Management. Note: Market data as of January 15, 2020. (1) Assumes ~$21 million ABL drawn at close, $50 million drawn under a new $75 million FILO debt facility, ~$3 million in existin g d ebt, and $5 million cash to AerSale balance sheet. Assumes a $10.00 illustrative share price. Adjusted EBITDA includes public co mpany cost assumptions. (2) Median and Mean excludes AerSale multiple. TEV / 2020E Adj. EBITDA ~100% value uplift should AerSale’s TEV / 2020F Adj. EBITDA multiple rerate to the median of the peer group Illustrative (2) Initial Valuation Relative to Public Aerospace Peers Represents an Attractive Investment Opportunity at a Compelling Valuatio n (1) (2)

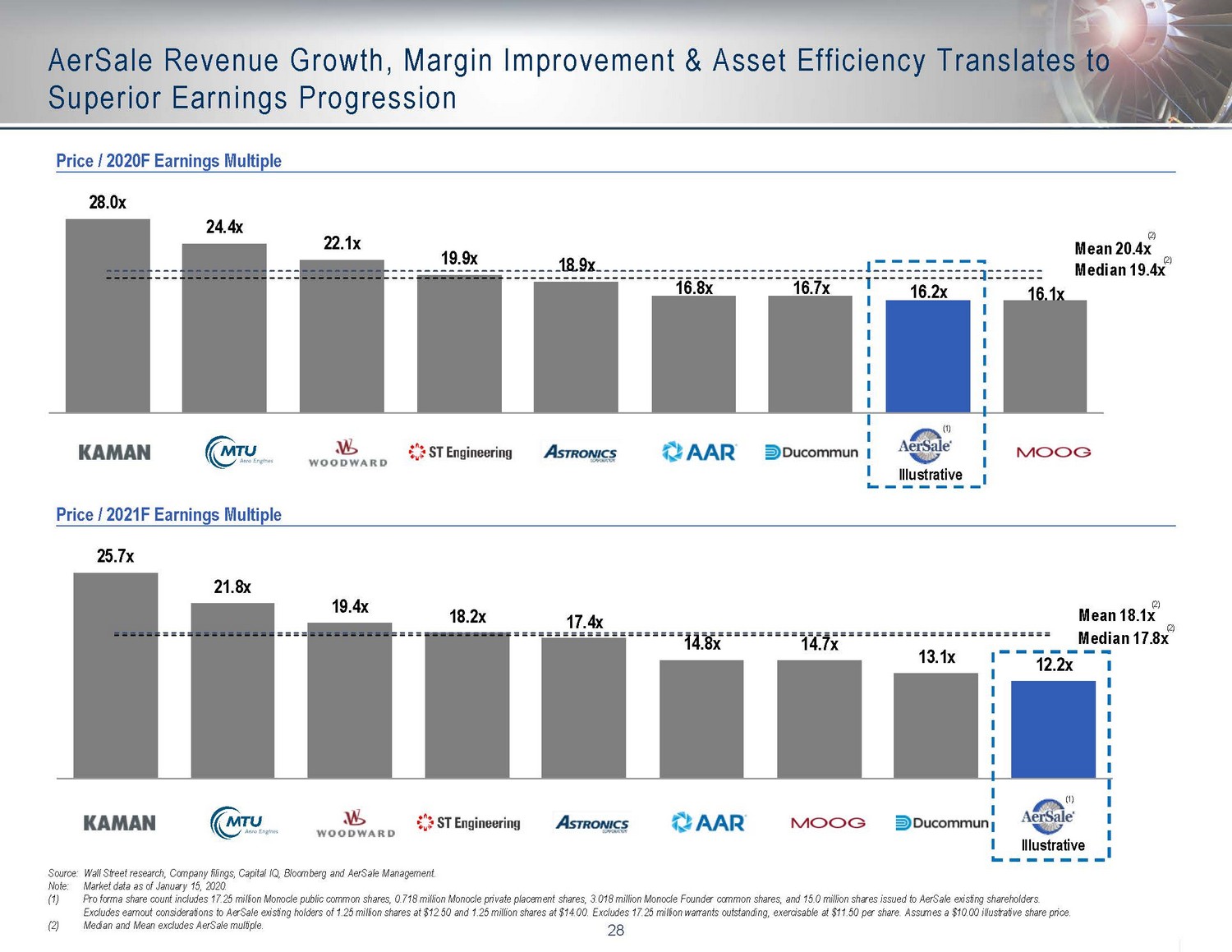

28 28.0x 24.4x 22.1x 19.9x 18.9x 16.8x 16.7x 16.2x 16.1x Median 19.4x Mean 20.4x 25.7x 21.8x 19.4x 18.2x 17.4x 14.8x 14.7x 13.1x 12.2x Median 17.8x Mean 18.1x AerSale Revenue Growth, Margin Improvement & Asset Efficiency Translates to Superior Earnings Progression 28 Source: Wall Street research, Company filings, Capital IQ, Bloomberg and AerSale Management. Note: Market data as of January 15, 2020. (1) Pro forma share count includes 17.25 million Monocle public common shares, 0.718 million Monocle private placement shares, 3. 018 million Monocle Founder common shares, and 15.0 million shares issued to AerSale existing shareholders. Excludes earnout considerations to AerSale existing holders of 1.25 million shares at $12.50 and 1.25 million shares at $14.0 0. Excludes 17.25 million warrants outstanding, exercisable at $11.50 per share. Assumes a $10.00 illustrative share price. (2) Median and Mean excludes AerSale multiple. Price / 2020F Earnings Multiple Price / 2021F Earnings Multiple Illustrative (1) Illustrative (1) (2) (2) (2) (2)

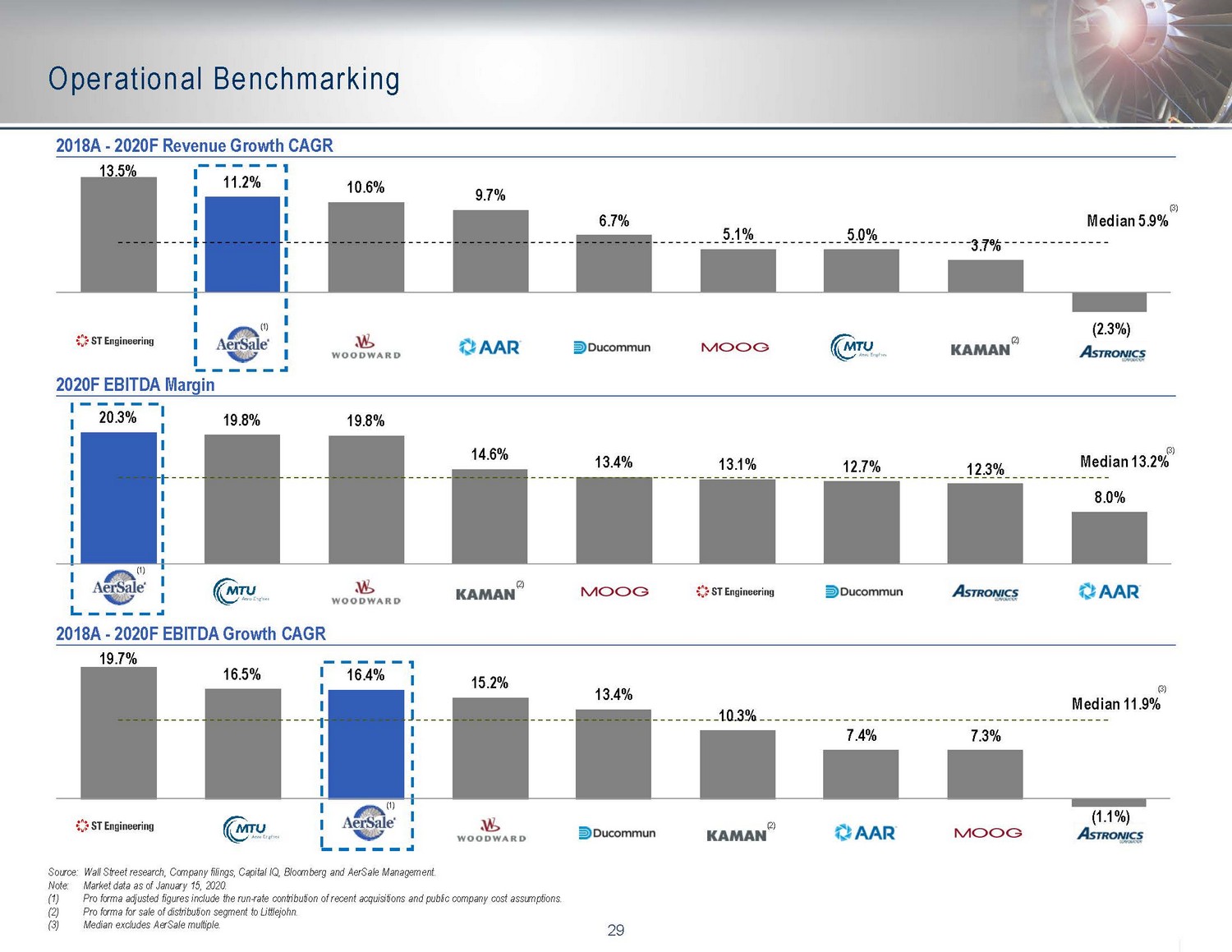

29 Operational Benchmarking 2018A - 2020F Revenue Growth CAGR 2020F EBITDA Margin 2018A - 2020F EBITDA Growth CAGR (2) (3) (3) (3) (1) (1) (2) (1) (2) Source: Wall Street research, Company filings, Capital IQ, Bloomberg and AerSale Management. Note: Market data as of January 15, 2020. (1) Pro forma adjusted figures include the run - rate contribution of recent acquisitions and public company cost assumptions. (2) Pro forma for sale of distribution segment to Littlejohn. (3) Median excludes AerSale multiple. 13.5% 11.2% 10.6% 9.7% 6.7% 5.1% 5.0% 3.7% (2.3%) Median 5.9% 19.7% 16.5% 16.4% 15.2% 13.4% 10.3% 7.4% 7.3% (1.1%) Median 11.9% 20.3% 19.8% 19.8% 14.6% 13.4% 13.1% 12.7% 12.3% 8.0% Median 13.2%

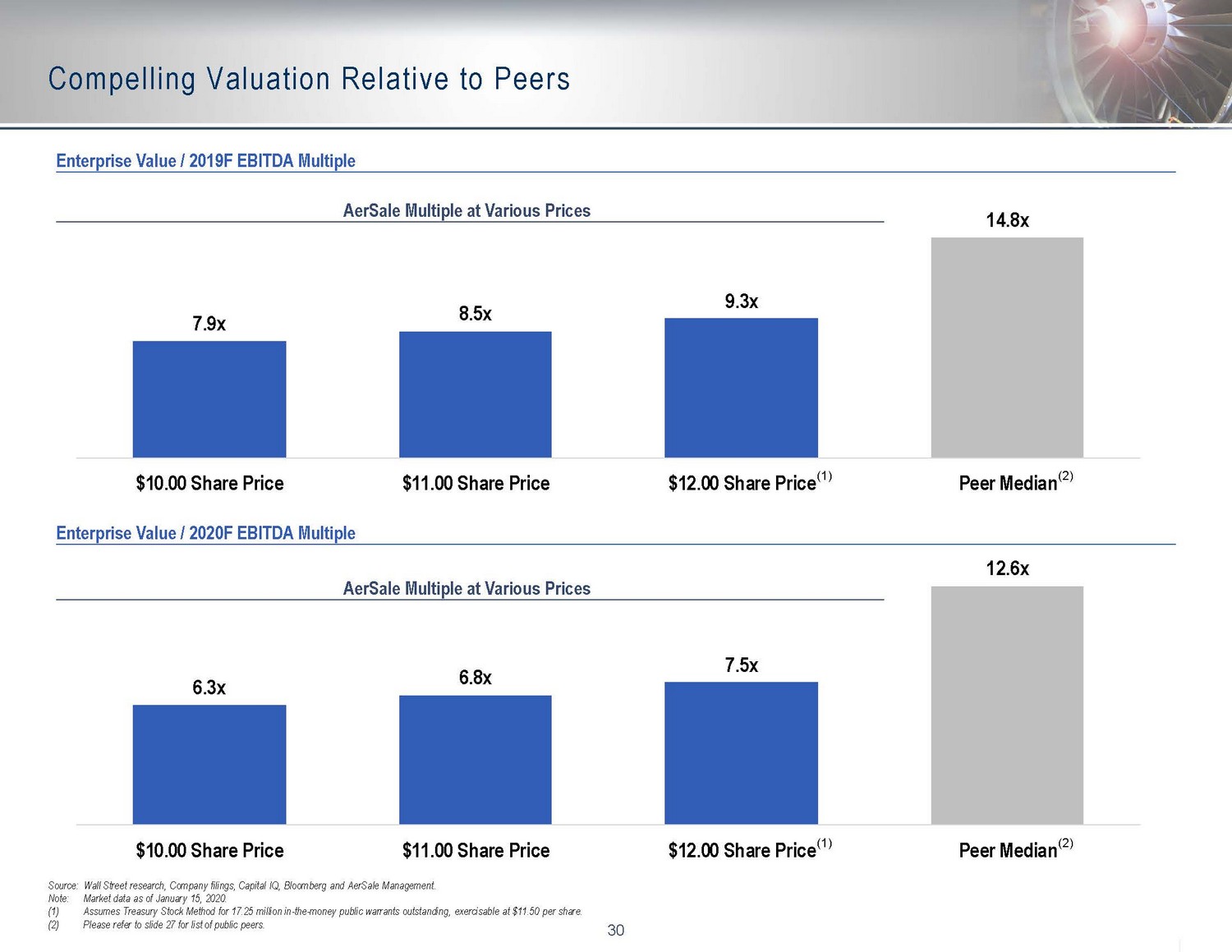

30 6.3x 6.8x 7.5x 12.6x $10.00 Share Price $11.00 Share Price $12.00 Share Price Peer Median Compelling Valuation Relative to Peers 30 Source: Wall Street research, Company filings, Capital IQ, Bloomberg and AerSale Management. Note: Market data as of January 15, 2020. (1) Assumes Treasury Stock Method for 17.25 million in - the - money public warrants outstanding, exercisable at $11.50 per share. (2) Please refer to slide 27 for list of public peers. Enterprise Value / 2019F EBITDA Multiple Enterprise Value / 2020F EBITDA Multiple (1) (2) AerSale Multiple at Various Prices AerSale Multiple at Various Prices (1) (2) 7.9x 8.5x 9.3x 14.8x $10.00 Share Price $11.00 Share Price $12.00 Share Price Peer Median

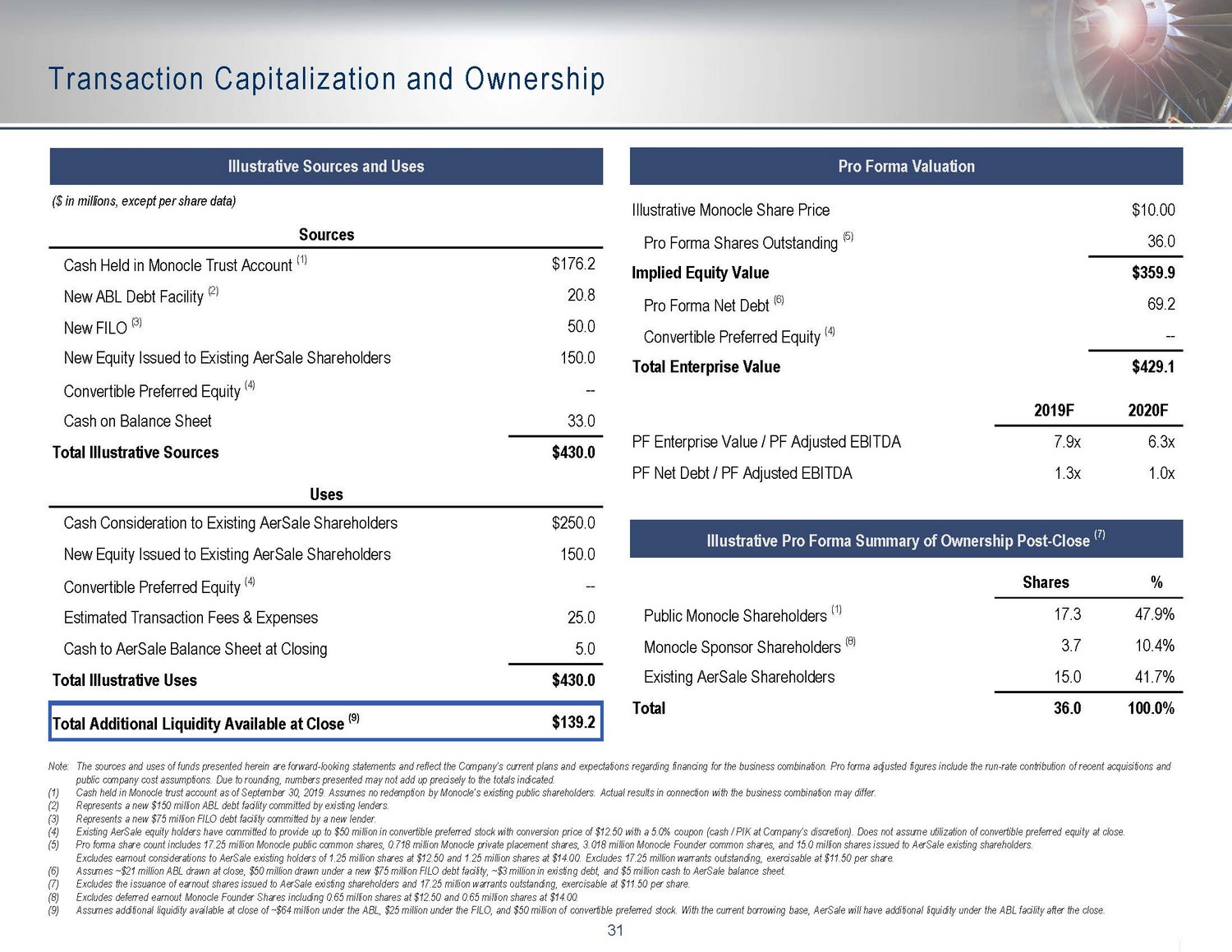

31 Transaction Capitalization and Ownership Note: The sources and uses of funds presented herein are forward - looking statements and reflect the Company’s current plans and expectations regarding financing for the business combination. Pro forma adjusted figures include the run - rate contribution of r ecent acquisitions and public company cost assumptions. Due to rounding, numbers presented may not add up precisely to the totals indicated. (1) Cash held in Monocle trust account as of September 30, 2019. Assumes no redemption by Monocle’s existing public shareholders. Ac tual results in connection with the business combination may differ. (2) Represents a new $150 million ABL debt facility committed by existing lenders. (3) Represents a new $75 million FILO debt facility committed by a new lender. (4) Existing AerSale equity holders have committed to provide up to $50 million in convertible preferred stock with conversion pr ice of $12.50 with a 5.0% coupon (cash / PIK at Company’s discretion). Does not assume utilization of convertible preferred equit y at close. (5) Pro forma share count includes 17.25 million Monocle public common shares, 0.718 million Monocle private placement shares, 3. 018 million Monocle Founder common shares, and 15.0 million shares issued to AerSale existing shareholders. Excludes earnout considerations to AerSale existing holders of 1.25 million shares at $12.50 and 1.25 million shares at $14.0 0. Excludes 17.25 million warrants outstanding, exercisable at $11.50 per share. (6) Assumes ~$21 million ABL drawn at close, $50 million drawn under a new $75 million FILO debt facility, ~$3 million in existin g d ebt, and $5 million cash to AerSale balance sheet. (7) Excludes the issuance of earnout shares issued to AerSale existing shareholders and 17.25 million warrants outstanding, exerc isa ble at $11.50 per share. (8) Excludes deferred earnout Monocle Founder Shares including 0.65 million shares at $12.50 and 0.65 million shares at $14.00. (9) Assumes additional liquidity available at close of ~$64 million under the ABL, $25 million under the FILO, and $50 million of co nvertible preferred stock. With the current borrowing base, AerSale will have additional liquidity under the ABL facility after the close. Pro Forma Valuation Illustrative Monocle Share Price $10.00 Pro Forma Shares Outstanding (5) 36.0 Implied Equity Value $359.9 Pro Forma Net Debt (6) 69.2 Convertible Preferred Equity (4) -- Total Enterprise Value $429.1 2019F 2020F PF Enterprise Value / PF Adjusted EBITDA 7.9x 6.3x PF Net Debt / PF Adjusted EBITDA 1.3x 1.0x Illustrative Pro Forma Summary of Ownership Post-Close (7) Shares % Public Monocle Shareholders (1) 17.3 47.9% Monocle Sponsor Shareholders (8) 3.7 10.4% Existing AerSale Shareholders 15.0 41.7% Total 36.0 100.0% Illustrative Sources and Uses ($ in millions, except per share data) Sources Cash Held in Monocle Trust Account (1) $176.2 New ABL Debt Facility (2) 20.8 New FILO (3) 50.0 New Equity Issued to Existing AerSale Shareholders 150.0 Convertible Preferred Equity (4) -- Cash on Balance Sheet 33.0 Total Illustrative Sources $430.0 Uses Cash Consideration to Existing AerSale Shareholders $250.0 New Equity Issued to Existing AerSale Shareholders 150.0 Convertible Preferred Equity (4) -- Estimated Transaction Fees & Expenses 25.0 Cash to AerSale Balance Sheet at Closing 5.0 Total Illustrative Uses $430.0 Total Additional Liquidity Available at Close (9) $139.2

Section IV Appendix

33 FY Ending December 31st, ($ in millions) 2017A 2018A Revenue, Net $174.7 $290.7 AerLine Divestiture Adjustment -- (53.7) Adjusted Revenue $174.7 $237.0 Normalized Full-Year Avborne Revenue 18.7 15.6 Normalized Full-Year Qwest Revenue 18.4 19.0 Pro Forma Adjusted Revenue $211.8 $271.6 Reported Net Income / (Loss) ($15.5) $26.7 Add-backs: Interest Expense / (Income) 6.8 2.0 Depreciation and Amortization 30.9 29.8 Income Tax Expense / (Benefit) (1.5) (3.2) AerLine Divestiture Adjustment -- (3.5) Management Fees 0.6 0.6 Legal Settlement 0.0 (3.0) One-Time Adjustments and Non-Recurring Items 4.0 (1.6) Adjusted EBITDA $25.3 $47.8 Normalized Full-Year Avborne EBITDA 1.2 1.1 Normalized Full-Year Qwest EBITDA 4.1 4.2 Public Company Costs (2.8) (2.8) Pro Forma Adjusted EBITDA $27.8 $50.3 33 Non - GAAP Consolidated Financial Reconciliation Source: AerSale Management. Note: Due to rounding, numbers presented may not add up precisely to the totals indicated. A B C D E F G H I Commentary Reflects discontinued operations of charter airline business sold in 2018 Includes pre - acquisition Avborne historical revenue as if acquired in Jan 2017 (acquired Nov 2018) Includes pre - acquisition Qwest historical revenue as if acquired in Jan 2017 (acquired May 2019) Reflects management fee paid to LGP for consulting and general management, transactional / financial advisory services Reflects adjustment related to successful litigation against an airline Reflects items identified as non - recurring or non - operating in nature and normalization of redundant and/or outlier activities including out - of - period leasing revenue, acquisition expense, normalized appraisal expense, and others Includes pre - acquisition Avborne historical adjusted EBITDA as if acquired in Jan 2017 (acquired Nov 2018) Includes pre - acquisition Qwest historical adjusted EBITDA as if acquired in Jan 2017 (acquired May 2019) Reflects estimated public company related expenses A B C D E F G H I A

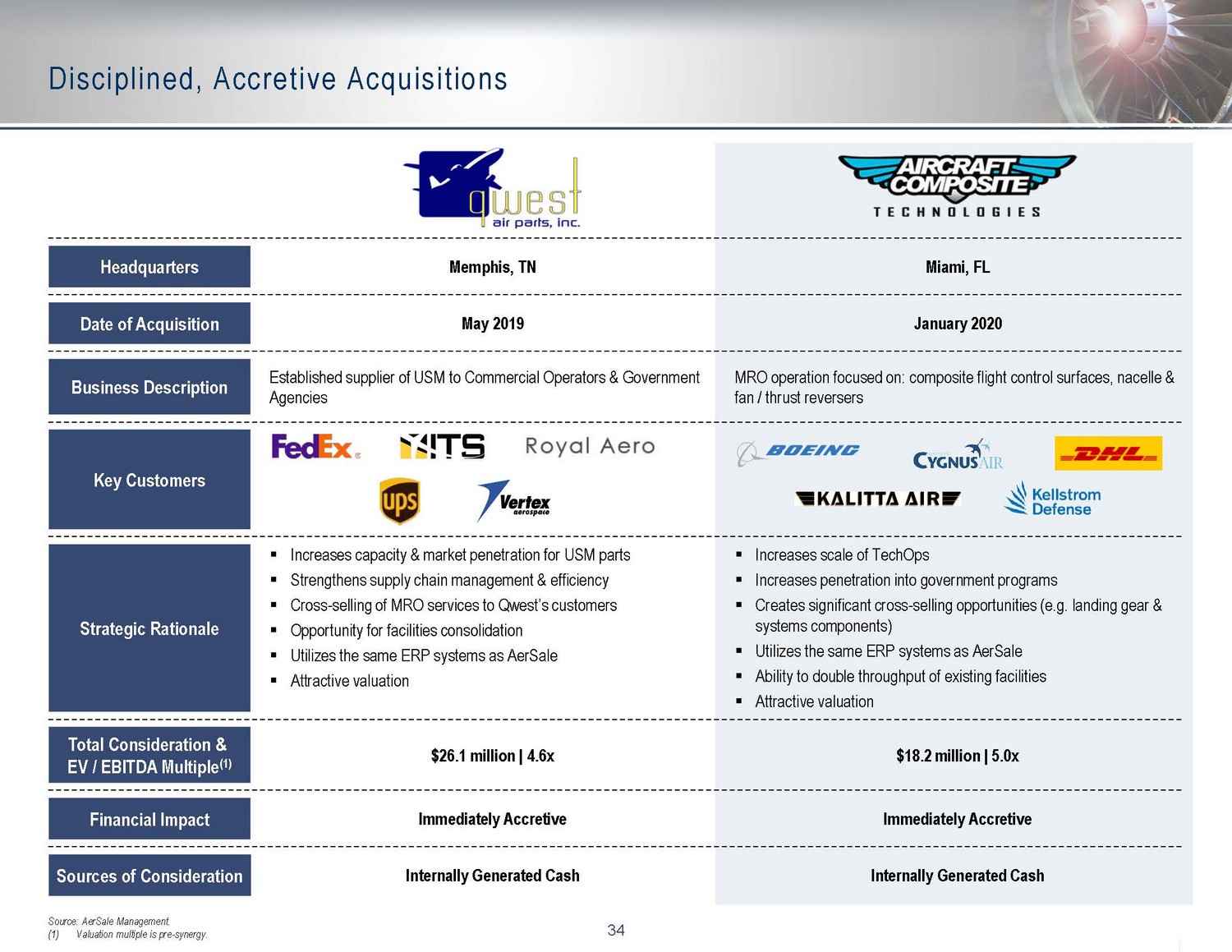

34 34 Disciplined, Accretive Acquisitions Business Description Established supplier of USM to Commercial Operators & Government Agencies MRO operation focused on: composite flight control surfaces, nacelle & fan / thrust reversers Date of Acquisition January 2020 May 2019 Headquarters Miami, FL Memphis, TN Key Customers Strategic Rationale ▪ Increases capacity & market penetration for USM parts ▪ Strengthens supply chain management & efficiency ▪ Cross - selling of MRO services to Qwest’s customers ▪ Opportunity for facilities consolidation ▪ Utilizes the same ERP systems as AerSale ▪ Attractive valuation ▪ Increases scale of TechOps ▪ Increases penetration into government programs ▪ Creates significant cross - selling opportunities (e.g. landing gear & systems components) ▪ Utilizes the same ERP systems as AerSale ▪ Ability to double throughput of existing facilities ▪ Attractive valuation Total Consideration & EV / EBITDA Multiple (1) $26.1 million | 4.6x $18.2 million | 5.0x Financial Impact Immediately Accretive Immediately Accretive Sources of Consideration Internally Generated Cash Internally Generated Cash Source: AerSale Management. (1) Valuation multiple is pre - synergy.